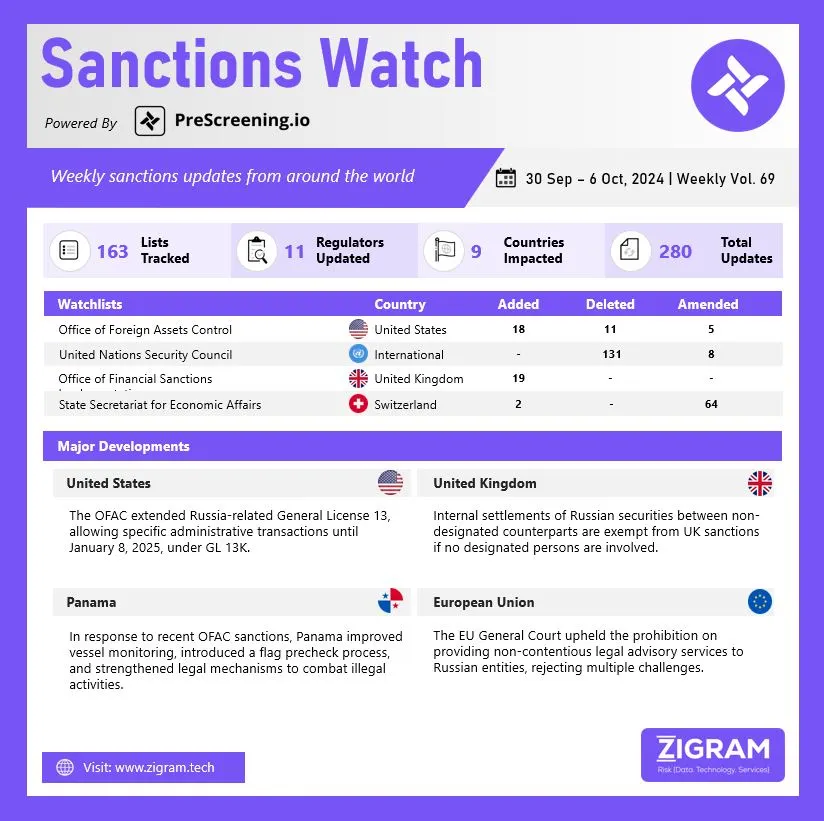

Sanctions Watch Vol 69

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

1. Panama To Revoke The Registration Of Any Vessel That Attempts To Evade Sanctions

In response to the inclusion of seven Panamanian-flagged vessels on the Office of Foreign Assets Control (OFAC) list, Panama has taken steps to minimize the placement of vessels on sanction lists. Key initiatives include transferring the Monitoring and Control Section from the Department of Navigation and Maritime Safety to the Maritime Ship Protection Department, which oversees international sanctions and fleet surveillance. Additionally, in September 2024, Panama launched the “Panama Flag Precheck Process,” setting prerequisites for flagging vessels and ensuring due diligence on ships, owners, and operators.

The country also signed the Registry Information Sharing Compact (RISC) to prevent vessels from switching registries to evade sanctions or engage in illegal activities. The General Directorate of Merchant Marine reviews further actions to deregister vessels linked to activities threatening national interests, international agreements, or the shipping industry. Legal mechanisms, such as Article 49 of General Law 57, enable the automatic cancellation of vessels involved in crimes like smuggling or piracy.

2. Internal Settlements Of Russian Securities Between Two Counterparts Exempt From UK Sanctions

Internal settlements of Russian securities between two counterparts with sub-accounts under the same non-designated entity are exempt from UK sanctions and do not require an OFSI license, provided certain conditions are met. These include ensuring that no designated person is involved in the transaction, either directly or indirectly, such as through the movement of securities or giving instructions. Additionally, no fees should be paid to a designated person, nor should instructions be given for such payments. Finally, the Russian securities involved must not violate other UK sanctions, such as Regulation 16, which addresses dealings with transferable securities.

3. OFAC Extends Authorizations Once More Under Russia General License 13

On September 30, 2024, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) extended its Russia-related General License (GL) 13 by issuing a revised version, GL 13K. This new license, titled “Authorizing Certain Administrative Transactions Prohibited by Directive 4 under Executive Order 14024,” allows U.S. persons to conduct certain administrative transactions, such as paying taxes, fees, import duties, and obtaining permits, licenses, or tax refunds.

These activities are permitted as long as they are necessary for day-to-day operations in Russia. Directive 4 restricts any dealings with the Central Bank of Russia, the National Wealth Fund, and the Ministry of Finance, including asset transfers or foreign exchange transactions on their behalf. While the previous GL 13J was set to expire on October 9, 2024, GL 13K extends its validity until January 8, 2025.

4. The EU Court Dismisses Challenges To Russia Sanctions On Legal Advisory Services And Clarifies The Scope Of The Prohibition

The General Court of the European Union dismissed challenges against the EU’s prohibition on providing legal advisory services to the Russian Government and entities. These challenges were filed by the Brussels Bar Association (T-797/22), the Paris Bar Association (T-798/22), and the Association Avocats Ensemble (T-828/22), aiming to annul Article 1(12) of Council Regulation 2022/1904, which amended Article 5n of Regulation 833/2014. Key judgments include that the ban does not violate the right to legal advice under the EU Charter of Fundamental Rights, as it permits advisory services in contentious legal matters.

The Court ruled that the prohibition applies only to non-contentious matters with no litigation link. The Court also found no breach of the duty to provide reasons, as the recitals justified the prohibition’s aim of restricting Russian access to EU goods and services. Additionally, the ban respects professional secrecy, and its scope and exceptions ensure proportionality and rule of law.

Know more about the product: PreScreening.io

Click here to book a free demo.

Sanctions Watch is a weekly recap of events and news related to sanctions around the world.

- #OFAC

- #Panama

- #MaritimeShipProtectionDepartment

- #RISC

- #UKsanctions

- #OFSI

- #GeneralLicense

- #GL

- #AdministrativeTransactions

- #CentralBankofRussia

- #NationalWealthFund

- #MinistryofFinance

- #EU

- #SanctionsWatch

- #InternationalSanctions

- #EconomicSanctions

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsViolations

- #BrusselsBarAssociation

- #ParisBarAssociation

- #AssociationAvocatsEnsemble