AML Supervision Report 2023-24

The Office for Professional Body Anti-Money Laundering Supervision (OPBAS) recently released its report for 2023/2024, offering an assessment of the anti-money laundering (AML) supervision carried out by Professional Body Supervisors (PBSs) in the UK’s legal and accountancy sectors. This comprehensive report examines the progress made, the challenges faced, and the areas that need improvement to safeguard the UK’s financial sector from money laundering activities. The findings highlight OPBAS’s ongoing efforts to ensure effective AML supervision and the critical role PBSs play as gatekeepers of the legitimate economy.

Key Objectives And Role Of OPBAS

OPBAS supervises 22 PBSs across the accountancy and legal sectors, with three others delegating their regulatory functions. Its primary goals are to ensure a high standard of supervision and to facilitate collaboration between PBSs, statutory AML supervisors, and law enforcement agencies. The role of OPBAS is central to reducing and preventing economic crime, ensuring that PBSs adopt a consistently high level of AML supervision across the UK. The aim is to promote a comprehensive, end-to-end approach that effectively deters criminal activity within the financial sector.

Summary Of The Report’s Findings

1. Effectiveness of PBSs

OPBAS’s evaluation revealed that while there has been some progress, no PBSs have yet achieved full effectiveness in all areas. Out of the nine PBSs assessed during this cycle, only three demonstrated marginal improvements in effectiveness. Most others either showed no change or experienced a decline. This trend indicates a persistent challenge in achieving the desired level of AML supervision across the legal and accountancy sectors.

2. Applying a Risk-Based Approach

A major concern identified by OPBAS is the inconsistent application of a risk-based approach by PBSs. Many PBSs failed to adequately substantiate the risk profiles assigned to their members, often relying on a narrow set of indicators. This lack of a comprehensive understanding undermines the effectiveness of AML supervision. For example, Trust and Company Service Providers (TCSPs), payroll services, and conveyancing remain top AML risks, but some PBSs displayed limited understanding and failed to take proactive measures to address these risks. Such gaps in applying a risk-based approach make PBSs less effective in mitigating AML risks within their supervised populations.

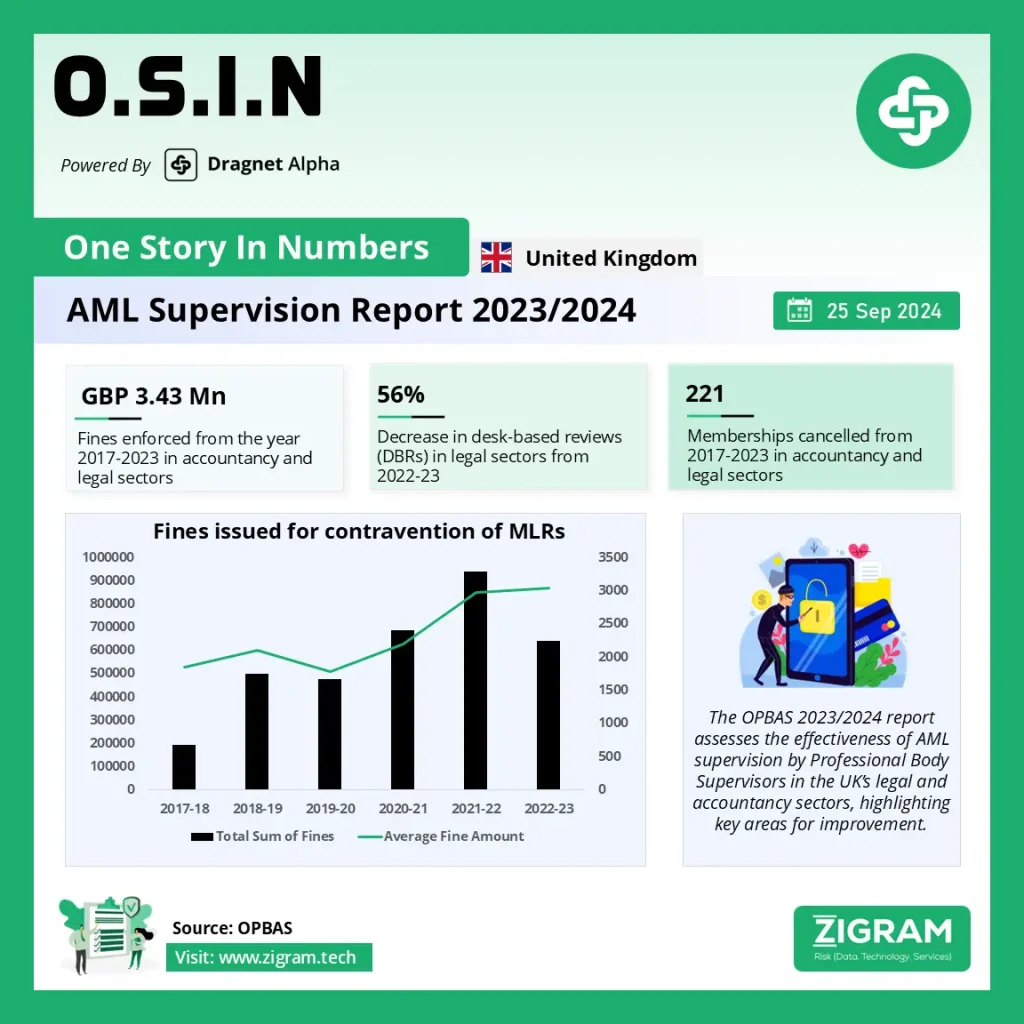

3. Enforcement Weaknesses

The report highlights considerable weaknesses in enforcement strategies among PBSs. Despite an increase in supervisory activity for non-compliance, there was a noticeable decline in both the number and value of fines issued during this period. This trend is concerning, as it indicates that PBSs are not using their enforcement powers in a dissuasive and proportionate manner. Moreover, the report found that many PBSs were reluctant to take more robust enforcement actions, preferring “assisted compliance” instead, which often fails to act as a credible deterrent against money laundering.

4. Information and Intelligence Sharing

Effective information and intelligence sharing is essential for reducing money laundering risks. While some improvements have been made, the report reveals that many PBSs still demonstrate inconsistencies in this area. There is reluctance among some PBSs to use established information-sharing gateways, such as those provided under the Money Laundering Regulations (MLRs), and limited sharing of live intelligence. This reluctance hinders the ability of law enforcement and other stakeholders to work together efficiently and makes it harder to disrupt illicit financial flows.

5. Outsourcing and Resourcing Issues

A notable finding of the report is that at least six PBSs have been outsourcing their AML supervision activities. The report raised concerns over the level of oversight exercised by these PBSs, as outsourced inspectors often lacked familiarity with the PBSs’ policies, procedures, and risk profiles. This inconsistency points to a broader issue of inadequate resourcing, with some PBSs not investing enough in their AML supervisory functions, thereby limiting their overall effectiveness.

Initiatives And Progress Made By OPBAS

1. Revised Sourcebook

In response to these challenges, OPBAS has taken proactive steps to enhance AML supervision standards. In January 2023, OPBAS published a revised sourcebook with clearer expectations and outcomes, setting a higher benchmark for PBSs. The revised sourcebook emphasizes the need for PBSs to fully embed these expectations into their supervisory practices and to demonstrate their effectiveness in all areas.

2. Engagement in the Economic Crime Plan (ECP2)

OPBAS has been actively involved in the UK’s second Economic Crime Plan (ECP2), co-authoring and launching the Professional Enablers Strategy in 2024. This strategy focuses on enhancing the role of legal and accountancy professionals in detecting and preventing the laundering of criminal proceeds. Through collaborations with statutory supervisors, law enforcement partners, and other stakeholders, OPBAS aims to strengthen the overall AML supervisory framework in the UK.

Key Priorities For The Year Ahead

1. Enhancing Intelligence Sharing

To improve the effectiveness of AML supervision, OPBAS plans to intensify efforts to facilitate better collaboration between PBSs, law enforcement, and other agencies. This will involve addressing the existing reluctance to share live intelligence and using established gateways more effectively to identify and respond to emerging threats.

2. Supporting

Improvements in AML Supervision

OPBAS will continue to utilize its regulatory tools to ensure that PBSs are adequately resourced and can effectively fulfill their AML supervisory roles. This includes monitoring the implementation of the revised sourcebook’s expectations and intervening more forcefully where PBSs fail to meet their obligations.

3. Driving Global Compliance

Recognizing the increasing international pressure to address money laundering, OPBAS will continue to collaborate with international partners to share information and best practices. By doing so, OPBAS aims to contribute to the global effort to raise standards for the supervision of non-financial bodies, ensuring that the UK’s approach aligns with international best practices.

The OPBAS 2023/2024 report serves as a critical assessment of the current state of AML supervision within the UK’s legal and accountancy sectors. It highlights the progress made, as well as the persistent challenges that need to be addressed to enhance the effectiveness of PBSs in combating money laundering risks. Despite some improvements, significant gaps remain, particularly in areas such as the risk-based approach, enforcement, and intelligence sharing. The report underscores the need for more proactive measures and greater collaboration to strengthen the UK’s AML framework.

PBSs must take the findings of this report as a call to action to improve their AML supervisory functions, ensuring they contribute effectively to the fight against financial crime. By adopting a more robust, risk-based approach, and enhancing enforcement and intelligence-sharing capabilities, PBSs can play a crucial role in safeguarding the integrity of the UK’s financial system. OPBAS remains committed to supporting this effort and driving continuous improvements in AML supervision, both nationally and globally.

Read the full report here.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #OPBASReport

- #AMLSupervision

- #FinancialCrime

- #MoneyLaundering

- #RiskBasedApproach

- #Enforcement

- #IntelligenceSharing

- #EconomicCrime

- #PBSs

- #AMLCompliance

- #UKFinance

- #FraudPrevention

- #AntiMoneyLaundering

- #FinancialRegulation

- #GlobalCompliance