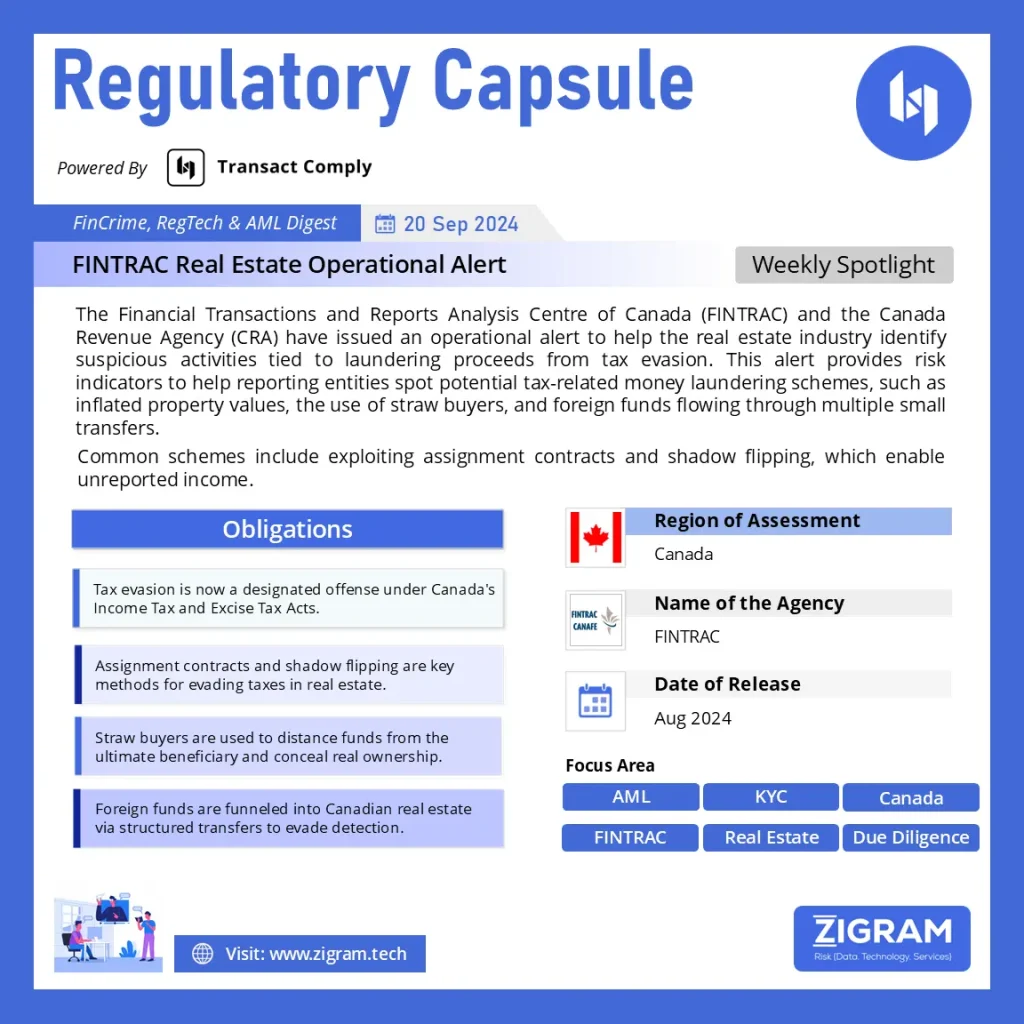

Regulation Name: Laundering The Proceeds Of Tax Evasion In Real Estate

Publishing Date: August 2024

Region: Canada

Agency: Financial Transactions And Reports Analysis Centre Of Canada

In a recent move to tackle the growing concern of tax evasion and money laundering in the real estate sector, the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) has partnered with the Canada Revenue Agency (CRA) to issue an operational alert aimed at industry stakeholders. This alert seeks to equip real estate professionals and financial institutions with the tools to identify and report suspicious financial activities linked to tax evasion through property transactions.

The alert comes at a critical time, as Canada’s real estate market continues to be a lucrative avenue for tax evaders and money launderers. The purpose of this initiative is to assist reporting entities, including real estate developers, brokers, and financial institutions, in recognizing transactions that may be attempts to launder proceeds derived from tax evasion.

Tax Evasion: A Growing Concern In Real Estate

Since 2010, tax evasion has been designated as a criminal offense under the Income Tax Act and Excise Tax Act. It involves the intentional non-compliance with tax laws through tactics like falsifying records, inflating expenses, and hiding income. The illicit funds generated through tax evasion are categorized as proceeds of crime, creating a close intersection between tax evasion and money laundering. This linkage enables criminals to disguise the origins of illegally obtained funds and reinvest them into the legitimate economy, often through real estate.

In recent years, real estate has been identified as a sector vulnerable to money laundering, with criminals exploiting it both as a destination for laundered funds and as a tool to conceal proceeds from illegal activities. Canadian real estate has attracted foreign capital and become a hub for laundering funds from global crime, particularly through opaque ownership structures, underground banking networks, and politically exposed individuals.

Real Estate Tax Evasion Methods

Tax evasion in real estate takes on many forms, making it essential for the industry to be vigilant. One common method involves manipulating property prices, often by using false identities or nominee buyers to hide the ultimate owner’s identity. This can be further complicated by the use of corporations or trusts, designed to obscure the beneficial ownership of properties.

Another notable tactic is the exploitation of assignment contracts, a strategy where a property is sold multiple times before being constructed or occupied. This practice, often used in pre-construction sales, allows developers or investors to generate unreported income through forfeited deposits and penalties from canceled sales. Similarly, shadow flipping—where properties are resold quickly between different buyers before closing—generates unreported profits and capital gains. Both strategies facilitate tax evasion by circumventing accurate reporting to tax authorities.

Red Flags In Real Estate Transactions

The operational alert outlines several key indicators that may point to suspicious activity linked to tax evasion and money laundering in the real estate sector. These red flags include:

1. Financing for property purchases provided by unlicensed lenders or private entities without a logical explanation.

2. Flow of funds through mortgage brokers, immigration consultants, or trust accounts in tax havens.

3. Transactions involving properties purchased using cash or by individuals with no apparent means of repaying a mortgage.

4. Assignment of contracts where the same property is sold multiple times before completion.

5. Discrepancies between the stated income or wealth of a client and the value of properties they purchase.

6. Use of family members to control different services in the real estate process, such as construction, brokerage, and legal services.

7. Suspicious use of foreign funds structured to evade transfer restrictions and funneled into Canadian real estate.

These red flags help reporting entities determine whether a transaction warrants further investigation and reporting to FINTRAC.

Addressing The Real Estate Sector’s Vulnerability

Real estate transactions are inherently complex, and criminals often take advantage of loopholes to launder proceeds from various crimes, including tax evasion. The alert highlights the importance of a comprehensive approach that considers multiple factors, such as a buyer’s profile, the transaction’s financial structure, and external contextual indicators.

For instance, the use of straw buyers—individuals who purchase property on behalf of someone else—has become a popular technique for evading taxes. These intermediaries are often chosen due to their lack of financial history, allowing the real beneficiary to remain anonymous. In such cases, fraudulent documents, like falsified pay stubs or altered tax slips, are used to secure mortgages.

Foreign capital flowing into Canadian real estate also raises concern. Electronic funds transfers (EFTs) structured to bypass currency restrictions in countries like China or Iran are being routed through multiple individuals or entities before reaching the ultimate beneficiary, who then uses these funds to purchase property. This practice further complicates the detection of suspicious activity, particularly when reporting entities face difficulties verifying information from overseas.

Strengthening Reporting And Compliance

FINTRAC’s alert underscores the crucial role reporting entities play in safeguarding Canada’s financial system. By enhancing their ability to identify suspicious transactions, the real estate sector can prevent criminals from abusing the system for tax evasion and money laundering. The alert encourages reporting entities to file comprehensive suspicious transaction reports (STRs) with FINTRAC when they detect red flags. These reports serve as vital tools in the fight against financial crime.

While STRs do not require proof of money laundering, they should include enough contextual information to support the suspicion. Reporting entities are urged to assess each transaction holistically, taking into account the client’s profile, the financial instruments used, and the circumstances surrounding the transaction.

The operational alert issued by FINTRAC and the CRA is a timely reminder of the risks associated with the real estate sector’s exploitation by tax evaders and money launderers. By equipping industry professionals with the knowledge to identify suspicious transactions, Canada strengthens its defenses against financial crime. As real estate continues to play a pivotal role in the national economy, protecting its integrity is essential to ensuring a stable, transparent, and fair market for all Canadians.

Read the details here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #RealEstateFraud

- #TaxEvasion

- #MoneyLaundering

- #Regulation

- #FinancialCrime

- #FINTRACAlert

- #CRASecurity

- #AMLCompliance

- #PropertyTransactions

- #SuspiciousActivity

- #FraudPrevention