Published Date:

The Federal Trade Commission (FTC)’s 2023 Annual Data Book provides insights into consumer protection and competition activities. It outlines enforcement actions, legal proceedings, and consumer complaints across various sectors. Key highlights include a rise in consumer reports related to fraud, identity theft, and online shopping issues, reflecting evolving challenges in the digital landscape.

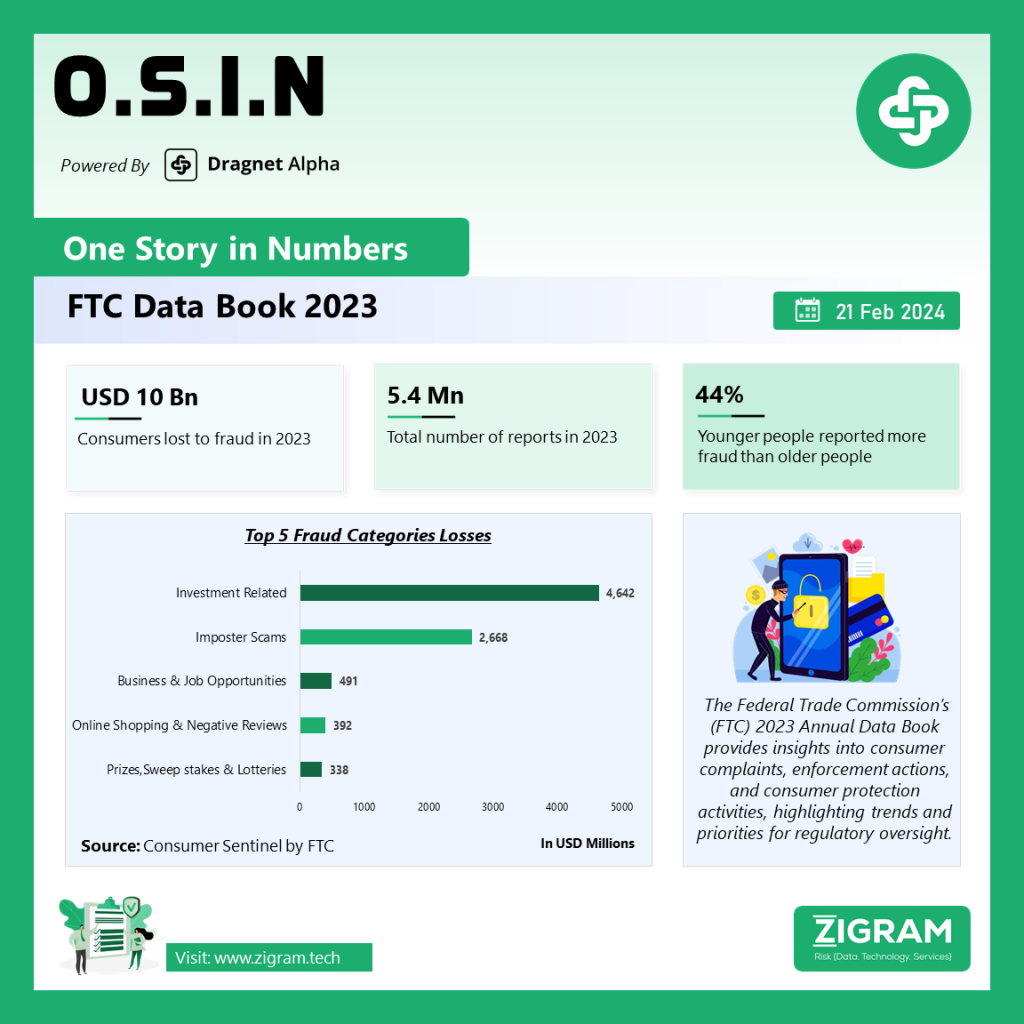

The Consumer Sentinel Network (CSN) received over 5.39 million reports in 2023, indicating a slight increase from the previous year. These reports encompassed various types of consumer complaints, with fraud comprising 2.6 million reports (48% of all reports), identity theft totalling 1.0 million reports (19%), and other issues accounting for 1.8 million reports (34%).

Notably, reports of identity theft constituted 19.2% of all reports, surpassing other types of complaints. Imposter scams, a subset of fraud reports, followed closely with 853,935 reports, representing 15.8% of all reports. Additionally, complaints regarding credit bureaus, information furnishers, and report users constituted 13.2% of all reports to Sentinel.

Fraud reports included 853,935 instances of imposter scams, with 21% reporting a financial loss totalling nearly $2.7 billion lost to imposter scams in 2023. These scams encompassed various fraudulent claims, such as false romantic interests, governmental impersonations, distress calls from relatives, fake businesses, and technical support scams aimed at extorting money from consumers.

Of the over 2.5 million fraud reports, 27% indicated financial losses, with reported losses exceeding $10 billion in 2023—an increase of over $1 billion from the previous year. Investment-related scams alone accounted for over $4 billion in reported losses.

The median loss for all fraud reports in 2023 was $500. Among the top 10 reported frauds, the highest median individual losses were observed in investment-related scams ($7,768), business and job opportunity scams ($2,137), and foreign money offers and counterfeit check scams ($1,900).

Email was the most common method of contact for fraud reports (24%), with 11% of those reports indicating a financial loss. However, this 11% reported an aggregate loss of over $430 million, with a median loss of $575.

Bank transfers and payments accounted for the highest aggregate losses reported in 2023 ($1.86 billion), followed closely by cryptocurrency ($1.41 billion), while credit cards were the most frequently identified payment method in fraud reports.

Regarding age demographics, individuals aged 20-29 reported financial losses to fraud in 44% of reports filed with the FTC, while individuals aged 70-79 reported losses in 25% of their reports, and those aged 80 and over reported losses in 22% of their reports. However, individuals aged 70 and older reported much higher median losses than any other age group when they did experience financial losses.

In terms of identity theft, credit card misuse was the most commonly reported type in 2023, with the FTC receiving 416,582 reports of information misuse with existing or new credit cards.

Military consumers reported over 93,000 fraud complaints, including 42,766 imposter scams, which reportedly cost them over $178 million in 2023.

Finally, states with the highest per capita rates of reported fraud in 2023 were Georgia, Florida, Nevada, Delaware, and Maryland, while the top states for reported identity theft were Georgia, Florida, Nevada, Connecticut, and Delaware.

- #FTC

- #ConsumerProtection

- #DataBook

- #Enforcement

- #RegulatoryOversight

- #ConsumerComplaints

- #2023Trends

- #ConsumerRights