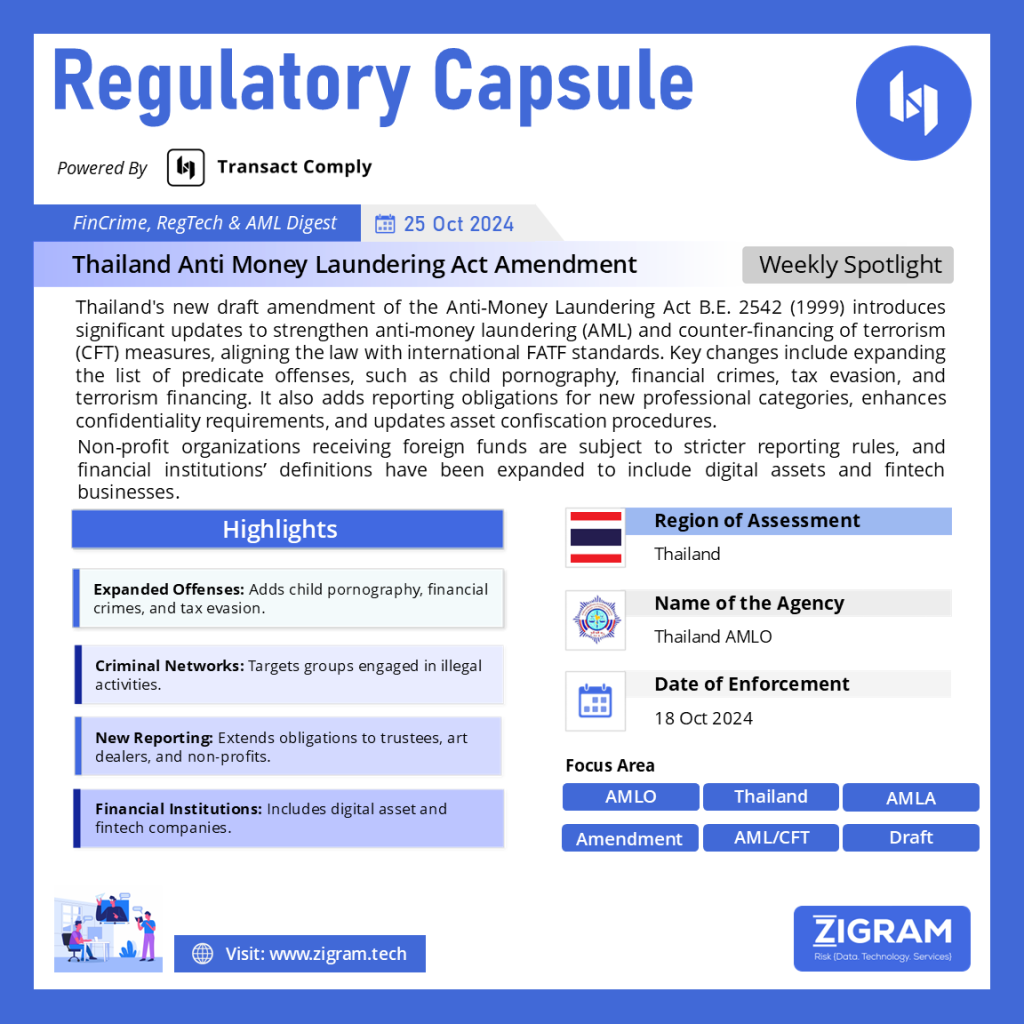

Regulation Name: Anti Money Laundering Act B.E . 2542 (1999)

Publishing Date: 18 October 2024

Region: Thailand

Agencies: Anti Money Laundering Office

Thailand is in the process of revising its Anti-Money Laundering Act B.E. 2542 (1999) (“AMLA”) to address areas of non-compliance with international standards set by the Financial Action Task Force (FATF). Some provisions of AMLA have become outdated and pose obstacles to effective enforcement. As a result, the government is considering amendments aimed at aligning AMLA with evolving international expectations and strengthening its anti-money laundering (AML) and counter-financing of terrorism (CFT) legal framework.

The new draft introduces several significant changes, broadening the scope of “predicate offenses” and enhancing various AML/CFT measures. Below are the key amendments proposed:

Key Changes in the Draft Amendment of AMLA:

1. Expanded and Amended Definition of Predicate Offenses

The scope of predicate offenses, which serve as the basis for prosecuting money laundering activities, has been broadened to include several new offenses. These changes reflect the ongoing evolution of financial crimes and modern threats. Notable offenses include:

a) Child Pornography: Offenses related to child pornography for commercial purposes.

b) Financial and Property Crimes: Embezzlement, fraud, crimes against property, unfair practices in futures contracts, securities, and digital asset trading, particularly when committed by managerial persons in financial institutions or trusts.

c) Customs and Trade Violations: Offenses involving the import or export of goods without customs clearance for commercial purposes.

d) Criminal Networks and Organized Crime: Participation in secret societies and transnational criminal organizations.

e) Document Forgery: Forgery of government documents, title documents, and passports, especially when conducted by criminal networks for commercial purposes.

f) Tax Evasion: Tax evasion linked to criminal networks, particularly when the evaded tax exceeds ten million baht or when fraudulent tax refund requests exceed two million baht annually.

g) Terrorism Financing: Offenses related to financing terrorist activities. Labor Exploitation: Forced labor conducted by criminal networks, particularly when resulting in serious harm or death.

h) Excessive Interest and Debt Collection: Charging excessive interest, using intimidation, or false debt collection tactics, especially when connected to a criminal network.

i) Bid Rigging and Corruption : Collusion in government bidding, using coercion or deceit to mislead and manipulate offer prices, especially in cases involving amounts exceeding one billion baht.

2. Inclusion of Criminal Networks

The draft introduces a definition for “Criminal Network,” referring to a group of three or more individuals collaborating for illegal financial or material gain.

3. Updated Definition of Financial Institutions

The draft expands the definition of “Financial Institution” to encompass a broader range of entities, including savings cooperatives, credit unions with capital exceeding 50 million baht, personal loan businesses, payment service businesses, digital asset businesses, and more, aligning the law with modern financial operations.

4. Reporting Obligations for New Professional Categories

The amendment adds new categories of professionals with reporting obligations, such as trustees, dealers in motorcycles, automobile leasing services, and art dealers. These professionals will be required to report suspicious transactions under AMLA.

5. Reporting Obligations for Non-Profit Organizations

Non-profit organizations (NPOs) that receive funds from foreign entities beyond limits set by the Anti-Money Laundering Office (AMLO) may be required to clarify the nature of the transactions. AMLO will also be authorized to temporarily suspend certain NPO transactions during investigations, with provisions for on-site inspections.

6. Standardized Reporting for Customs Officers

Customs officers must now report all transactions involving the transfer or importation of currency, foreign currency, or negotiable instruments to AMLO, regardless of the transaction amount.

7. Enhanced Confidentiality and Reporting Procedures

The draft introduces stricter rules for handling reports of suspicious transactions, enhancing confidentiality requirements for professionals and institutions involved in reporting.

8. Consolidated 5-Year Information Retention Requirement

All information or evidence gathered under AMLA’s reporting requirements must be retained for at least five years from the end of a business relationship. In some cases, the retention period may extend up to ten years.

9. Enhanced Asset Confiscation Procedures

The draft amendment improves the process for confiscating assets linked to money laundering while protecting the rights of innocent parties. It also empowers prosecutors to petition the court to revoke encumbrances on assets tied to money laundering.

Legislative Progress

As of August 16, 2024, the draft amendment has passed through the legislative process and public hearings conducted by the Office of the Council of State. It has been submitted to the Thai Cabinet and is awaiting approval from the House of Representatives and the Senate.

This amendment marks a significant step in Thailand’s efforts to strengthen its AML and CFT frameworks, ensuring compliance with FATF standards and addressing the country’s evolving financial crime risks. The expanded scope of offenses, new reporting requirements, and stricter asset confiscation processes underscore Thailand’s commitment to combating financial crimes and enhancing law enforcement capabilities.

Read the details here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #Thailand

- #AMLA

- #AntiMoneyLaundering

- #FATF

- #FinancialCrimes

- #CFT

- #CriminalNetworks

- #DigitalAssets

- #Regulation

- #AssetConfiscation

- #TaxEvasion

- #FinancialInstitutions