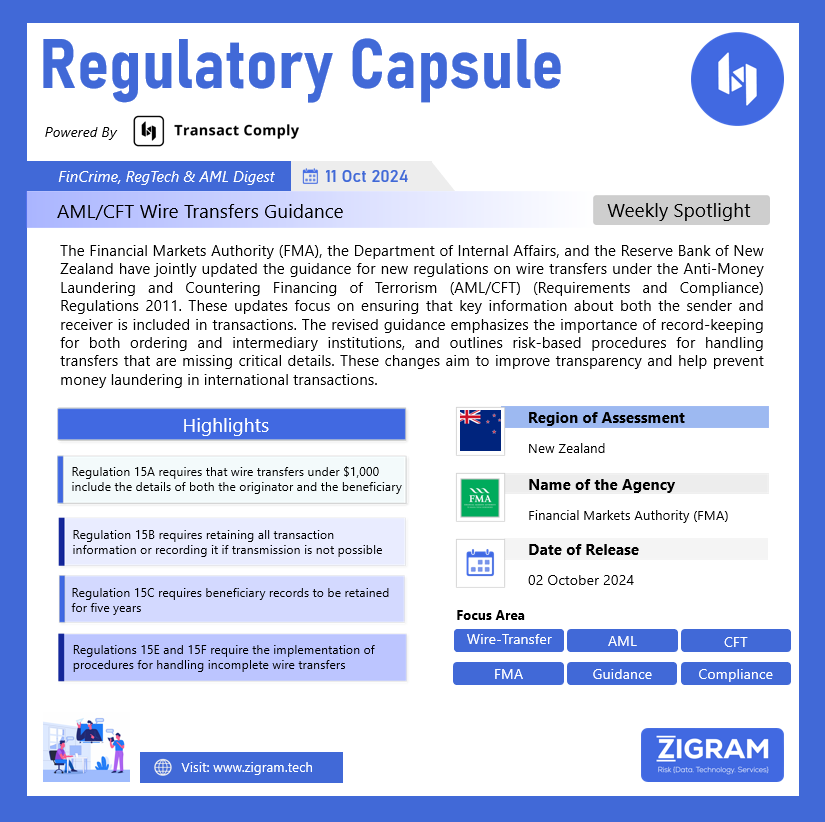

Regulation Name: Guidance For The New Regulations Relating To Wire Transfers In AML/CFT (Requirements And Compliance) Regulations 2011

Publishing Date: 02 October 2024

Region: New Zealand

Agencies: The Financial Markets Authority (FMA), Department of Internal Affairs, and the Reserve Bank of New Zealand

On October 2, 2024, the Financial Markets Authority (FMA), the Department of Internal Affairs, and the Reserve Bank of New Zealand jointly issued amended guidance for new regulations related to wire transfers under the Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) (Requirements and Compliance) Regulations 2011. The update prioritizes ensuring that essential sender and receiver information accompanies each wire transfer. It emphasizes the importance of record-keeping for both ordering and intermediary institutions, as well as risk-based approaches for managing transfers that lack critical details. These enhancements are designed to increase transparency and combat money laundering in international financial transactions.

Regulation 15A – For Ordering Institutions

It introduces new requirements for ordering institutions handling international wire transfers below $1,000. For every such transfer, the institution must ensure that the following details are included with the transaction:

• The originator’s full name

• The originator’s account number or another identifier that can trace the transaction back to them

• The beneficiary’s name

• The beneficiary’s account number or a unique transaction reference number

Verification of this information is not mandatory unless there is reason to suspect that the transaction may be linked to suspicious activity. In cases of suspicion, only the originator’s full name must be verified.

Regulation 15B – For Intermediary Institutions

As an intermediary institution in a wire transfer, your key responsibility is to ensure that all accompanying information remains intact when transferring funds to another intermediary or a beneficiary institution. However, there are instances, particularly with international wire transfers, where this may not be feasible due to technical limitations in your processing systems or other technological challenges.

In such cases, Regulation 15B mandates that if you are unable to transmit the full set of information due to technological reasons, you must retain a record of the information received for a period of five years following the transaction.

Regulation 15C – Record-Keeping Requirements For Ordering Institutions

Regulation 15C mandates that ordering institutions involved in international wire transfers maintain comprehensive records of the beneficiary’s name and either the beneficiary’s account number or the unique transaction reference number associated with the transfer. These records must be retained for five years following the conclusion of the business relationship with the customer related to the wire transfer. For occasional transactions, the five-year retention period begins from the date of the transaction. This requirement is consistent with other record-keeping obligations concerning originator information as outlined in Section 50 of the Act.

Regulation 15E – For Intermediary Institutions

Regulation 15E establishes supplementary obligations for intermediary institutions concerning international wire transfers. As an intermediary institution, your Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) program must incorporate robust and effective policies, procedures, and controls, including:

a) Defining the reasonable measures, you will implement to identify any international wire transfers that lack the required originator or beneficiary information as mandated by the Act or regulations.

b) Developing risk-based policies and procedures to be applied when an international wire transfer is missing any of the necessary information.

Regulation 15F – For Beneficiary Institutions

As a beneficiary institution, you are required to implement effective risk-based procedures for managing wire transfers that do not include all the necessary originator and beneficiary information. Regulation 15F mandates that your Anti-Money Laundering (AML) and Countering Financing of Terrorism (CFT) program must include appropriate and effective policies, procedures, and controls for:

a) Identifying reasonable steps to detect international wire transfers that are missing the required originator or beneficiary information as stipulated by the Act or regulations.

b) Establishing risk-based policies and procedures to be applied when an international wire transfer lacks any of the necessary information.

Read the details here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #AMLCompliance

- #CFTRegulations

- #WireTransfers

- #FinancialCrime

- #MoneyLaundering

- #RegulatoryCompliance

- #RiskManagement

- #FMA

- #NewZealandFinance

- #TechnologyExport

- #InternationalRelations