INDUSTRIES

Fintechs

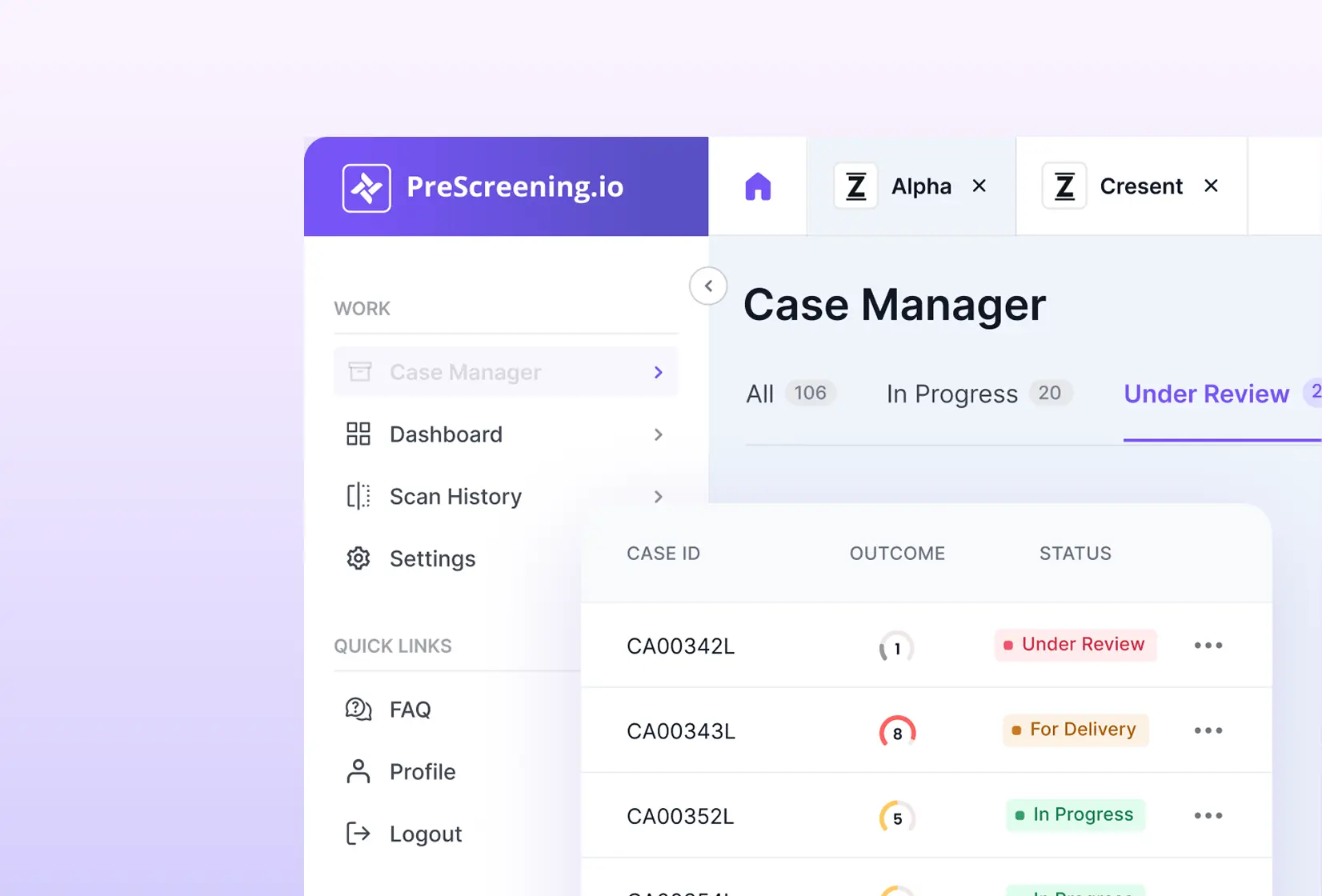

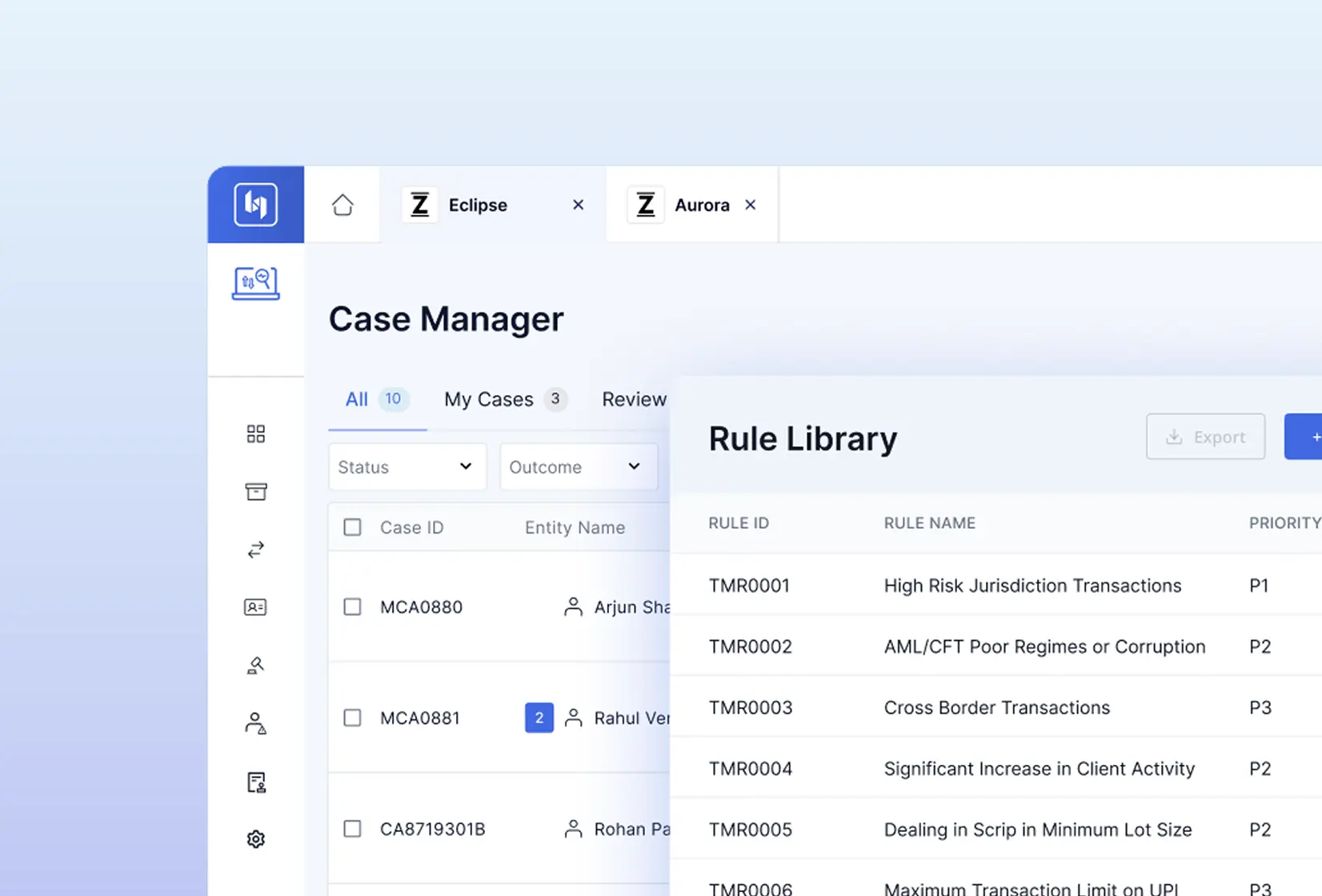

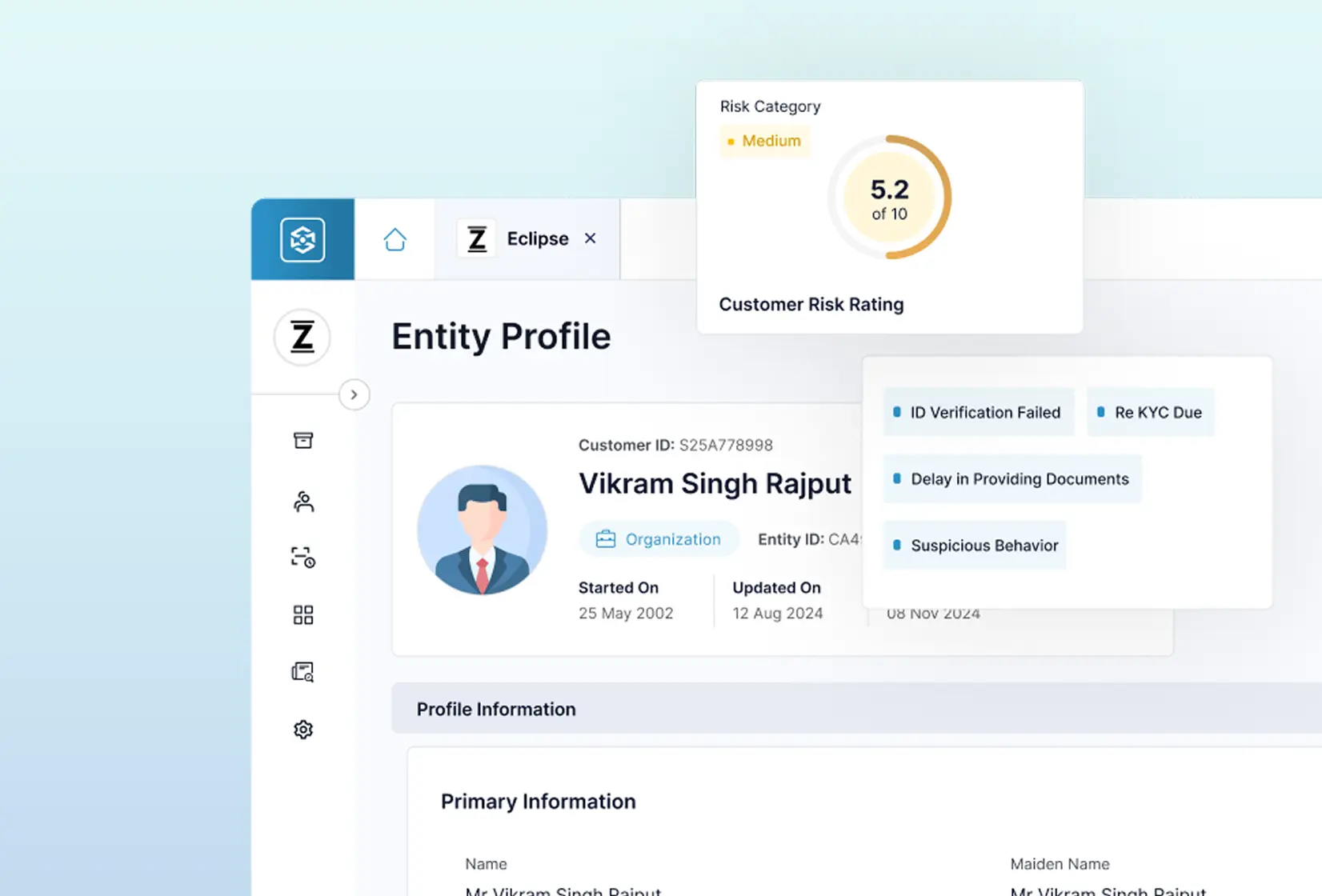

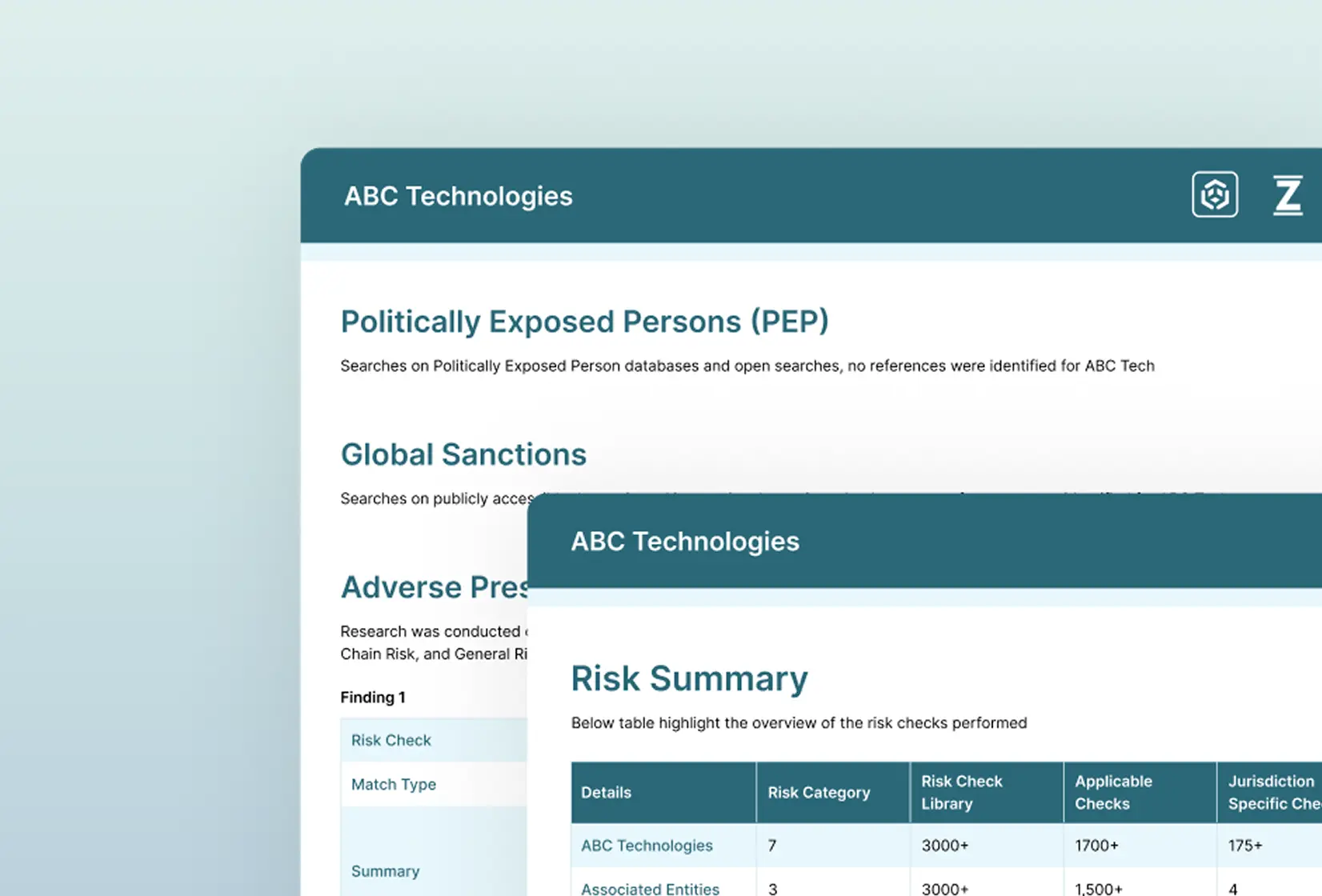

Fintech companies must balance innovation with financial crime risk management. As transaction volumes grow, so do fraud and compliance challenges. ZIGRAM’s scalable RegTech solutions help fintechs automate KYC, monitor transactions, and prevent financial crimes without slowing down growth.