The Reserve Bank of India (RBI) has escalated its scrutiny of Fintech companies in the wake of compliance lapses, exemplified by its recent actions against Paytm Payments Bank. As regulatory pressure mounts, several prominent players in the Fintech arena face the specter of enforcement actions. Against the backdrop of an ongoing audit by the Financial Action Task Force (FATF), India’s adherence to global Anti-Money Laundering (AML) standards assumes heightened significance.

RBI's Actions Against Paytm:

- On January 31, the RBI imposed significant restrictions on Paytm Payments Bank, prohibiting it from onboarding new customers due to compliance deficiencies in its KYC process.

- This regulatory intervention highlights the central bank's dedication to maintaining stringent AML (Anti-Money Laundering) standards and emphasizes the repercussions of non-compliance for Fintech entities.

- The scrutiny by the Enforcement Directorate of senior Paytm executives further accentuates the seriousness of the compliance lapses and the regulatory consequences.

- Additionally, One97 Communications, the parent company of Paytm, revealed that it has received notices and requests for information from regulatory authorities, indicating broader regulatory scrutiny of the company.

Fintechs Under Regulatory Radar:

- According to a report by Moneycontrol, besides Paytm, four other payment providers are currently under scrutiny for lapses in their KYC processes.

- Limited or ineffective supervisory and enforcement capabilities.

- Leading payment aggregators and wallet service providers are among those facing scrutiny, highlighting the importance of robust compliance frameworks.

- Regulatory scrutiny extends to firms operating in the unsecured loan segment, serving as intermediaries between customers and lenders.

- Concerns over KYC deficiencies and the potential misuse of mule accounts have prompted regulatory authorities to take preemptive measures.

- The recent directives issued to Visa and Mastercard to halt card-based commercial payments reflect the RBI's determination to enforce strict KYC norms.

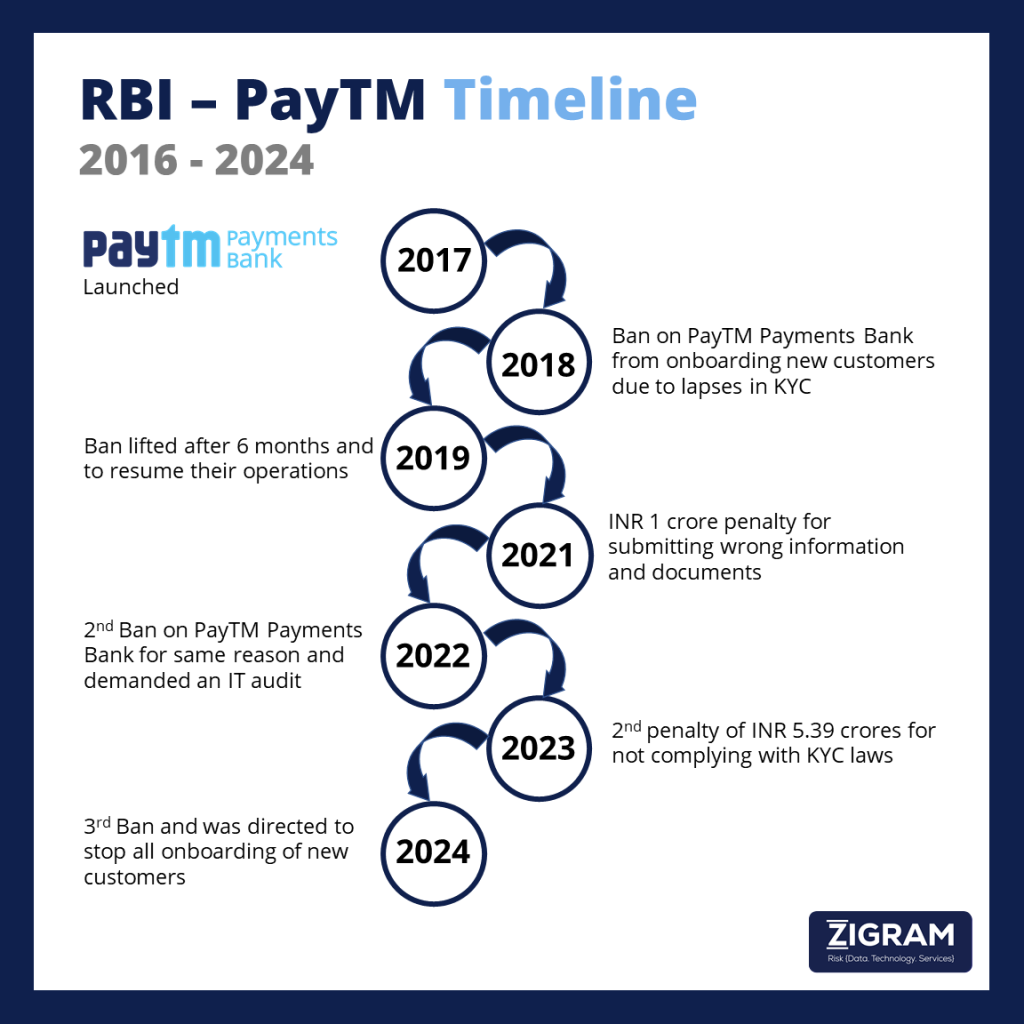

RBI PayTM Feud Timeline:

PayTM CEO, Vijay Shekhar Sharma, was one of the 11 recipients of payments bank license from RBI in 2016. This gave way to the founding of PayTM Payments Bank in 2017. Here is how the story unfolded that led to RBI’s decision on 31 January 2024.

Regulatory Landscape in Fintech Sector:

- The regulatory landscape is undergoing rapid changes, driven by recent guidelines focusing on digital lending, card tokenization, and personal data protection, which are reshaping industry practices.

- Regulatory bodies like the RBI, Enforcement Directorate, FIU, tax department, SEBI, and IRDAI play crucial roles in overseeing compliance with anti-money laundering norms and ensuring the integrity of financial transactions.

- Globally, financial regulators are increasing scrutiny on fintech firms due to concerns related to monopolistic behavior, data security, money laundering, and systemic risks, highlighting the necessity for robust regulatory oversight.

- The RBI's proactive measures align with international trends, contrasting with previous laissez-faire approaches in major markets like China, indicating a shift towards stricter regulations to address emerging challenges in the fintech sector.

RBI's Concerns and Inspections on Customer Identification and Due Diligence:

- The RBI has expressed apprehensions regarding the digital customer identification process adopted by fintech firms, especially the heavy reliance on Aadhaar and linked mobile numbers for identity verification.

- Despite offering speed and cost-efficiency, this method is vulnerable to manipulation, which significantly escalates the risks associated with fraud and money laundering.

- While not outright prohibiting its usage, the RBI has mandated that digitally verified accounts should be categorized as 'high risk' until physical or video-call-based identification is conducted, underscoring the necessity for more rigorous due diligence measures.

- To ensure compliance and authenticity, RBI officials are conducting frequent onsite inspections, where random samples of fintech firms' user bases are scrutinized to verify their adherence to regulations and the authenticity of their processes.

Navigating Regulatory Frameworks:

- The business regulatory ecosystem in India encompasses a vast array of acts and rules, totaling 1,536, along with over 69,000 compliance obligations, as reported by Financial Express.

- Fintech entities operating in the country are required to register with the RBI under the RBI Act, 1934, and associated regulations, depending on the nature of financial services offered.

- The Reserve Bank directly regulates certain fintech firms by granting them NBFC licenses, such as NBFC-P2P, or indirectly by overseeing associated banks and NBFCs.

- According to the Payment and Settlement Systems Act, 2007, the initiation and operation of any payment system in India necessitate prior authorization from the RBI.

- Recent regulatory initiatives, such as the Guidelines on Digital Lending, have been implemented by the RBI to protect borrowers from increasing instances of digital loan fraud.

- These guidelines mandate that all loan disbursals and repayments occur exclusively between the borrower's bank accounts and regulated entities (REs), prohibiting third-party involvement and automatic credit limit increases without explicit borrower consent.

- Additional stipulations include the direct payment of fees/charges by REs to LSPs, standardized Key Fact Statements (KFS) for borrowers, and a cooling-off period for borrowers to exit digital loans without penalty.

- Fintech companies must navigate a complex web of regulatory frameworks and guidelines to ensure compliance and effectively mitigate risks.

- Notable acts and guidelines include Master Directions on Prepaid Payment Instruments (MD-PPIs) 2021, Framework for Scale-Based Regulation for Non-Banking Financial Companies 2021, Guidelines for Licensing of Payments Banks 2014, Operating Guidelines for Payments Banks 2016, and Circular on Processing of e-mandate on cards for recurring transactions 2019.

Compliance Measures and Strategies:

- Fintech firms must prioritize compliance with regulatory standards to mitigate risks effectively.

- Staying informed about RBI directives, including Master Circulars and Master Directions, is essential to align operations with regulatory expectations.

- Digitizing internal processes enables enhanced monitoring and risk management, facilitating real-time transaction tracking and robust Know Your Customer (KYC) procedures.

RBI’s Actions Coinciding with FATF’s Ongoing Audit:

- The RBI's regulatory crackdown coincides with an ongoing audit by FATF, assessing India's adherence to global Anti-Money Laundering (AML) standards.

- Adherence to high documentation standards, particularly robust KYC processes, is crucial for India to maintain its position on FATF's green list and attract foreign investment.

- The audit's findings will significantly influence India's financial system and regulatory landscape, shaping future AML policies and enforcement actions.

- FATF's review emphasizes the importance of KYC documentation by banks and financial institutions to prevent illegitimate money from entering the banking systems, potentially funding terrorism or tax evasion.

- Regulatory actions by the RBI will depend on the extent of lapses, including KYC deficiencies and the presence of mule accounts used for illegal activities.

- The COVID-19 pandemic delayed FATF's review, initially scheduled for 2020, to 2023-24, with the assessment expected to conclude by June.

Finance Minister's Push for Compliance:

- Finance Minister Nirmala Sitharaman is set to engage with Fintech stakeholders to emphasize KYC compliance, addressing industry concerns and reinforcing regulatory obligations.

- The upcoming meeting, scheduled for February 26 or 27, anticipates participation from over 20 Fintech firms across lending, payment processing, and mutual funds sectors, with senior RBI officials also present.

- While Paytm is not part of the meeting, the Finance Minister aims to foster dialogue and collaboration between regulatory authorities and Fintech entities to enhance compliance frameworks.

In response to the escalating regulatory scrutiny faced by Fintech firms, it has become increasingly crucial for these entities to adopt robust compliance solutions to effectively navigate the evolving regulatory landscape. Compliance goes beyond being a mere legal requirement; it has emerged as a strategic imperative for Fintech firms striving to thrive amidst the rapid changes in regulations.

ZIGRAM is the one-stop solution for all your compliance needs. Try our FREE DEMO to experience what you’re missing in your AML and KYC processes!

- #RBI

- #Fintech

- #Paytm

- #AML

- #Compliance