In today’s business landscape, companies face a complex array of risks, including financial crime, fraud, and money laundering. To mitigate these risks, businesses must implement robust compliance frameworks that include Customer Due Diligence (CDD) measures. CDD is an essential aspect of anti-money laundering (AML) compliance, and it involves verifying the identities of customers, assessing their risk levels, and monitoring their activities to detect suspicious behavior. Whether you are a financial institution, a service provider, or a business in any industry, customer due diligence plays an important role in safeguarding your operations and reputation.

The Importance and Purpose of Customer Due Diligence in AML Compliance

Why Customer Due Diligence Is Essential for Businesses

Customer due diligence helps organizations prevent fraud, money laundering, and other financial crimes. By conducting thorough background checks on customers, businesses can identify any potential risks or red flags that may indicate illicit activities. It is essential for maintaining regulatory compliance. Many industries, especially the financial sector, are subject to strict regulations and laws that require businesses to carry out due diligence on their customers.

Failing to comply with these regulations can result in severe penalties, legal consequences, and reputational damage. Customer due diligence is crucial for building trust and confidence with customers. By demonstrating that you have implemented robust due diligence processes, you reassure your customers that their information and transactions are secure. This, in turn, enhances your reputation and helps attract and retain loyal customers.

The Role of Customer Due Diligence in Anti-Money Laundering Programs

CDD is a critical component of AML compliance, as it helps businesses identify and mitigate the risk of money laundering and terrorist financing. The process involves collecting and verifying information about customers to ensure that they are who they claim to be and that their activities are legitimate. By conducting CDD, organizations can identify high-risk customers, such as politically exposed persons (PEPs), and apply enhanced due diligence (EDD) measures to mitigate these risks.

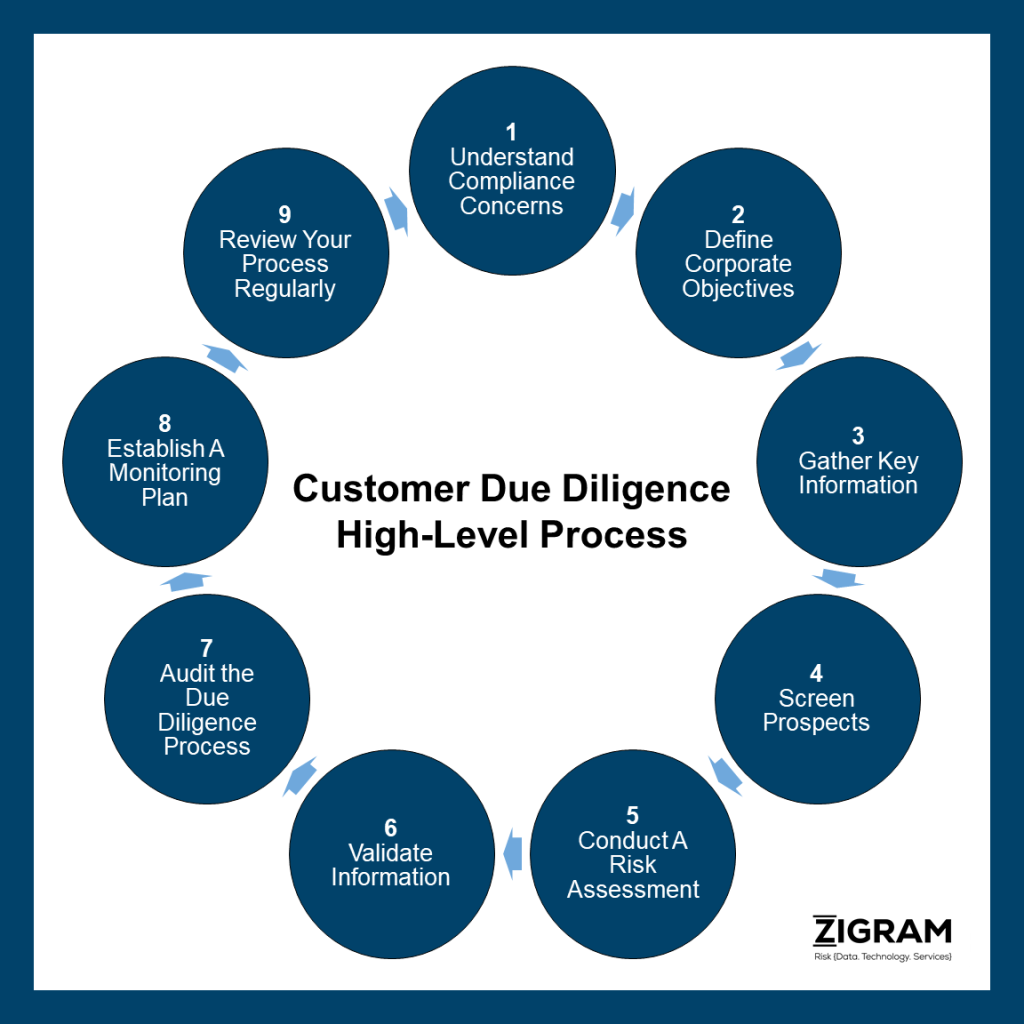

Customer Due Diligence Process and Key Components

CDD process key components includes:

Verifying Customer Identities (KYC Process)

The fundamental aspect of CDD is the Know Your Customer (KYC) requirement, which involves collecting and verifying customer information. This can be achieved through various methods, such as document verification, biometric authentication, and database checks. It's essential to use robust identity verification measures to prevent fraud and ensure that customers are not using false identities.

Assessing Customer Risk Levels Through Comprehensive Due Diligence

To effectively evaluate the risk associated with customers, businesses must conduct thorough due diligence checks on their activities, sectors, and related entities. This involves gathering information from multiple sources, such as public records, media sources, and government agencies. By conducting comprehensive due diligence, companies can identify potential red flags and apply appropriate risk mitigation measures.

Ongoing Monitoring for Continued Compliance

It's crucial to continuously monitor customer activities to detect any suspicious behavior that may indicate money laundering or other financial crimes. This can be achieved through the use of automated systems that analyze transaction data and flag any unusual patterns or behaviors. Ongoing monitoring is essential for sustained risk mitigation and compliance with AML regulations.

Customer Due Diligence In The Banking Industry

Why Customer Due Diligence Is Crucial in the Banking Sector

In the banking industry, customer due diligence is of utmost importance. Banks are prime targets for money laundering and financial crimes due to the large volume of transactions they handle. Therefore, implementing stringent customer due diligence measures is crucial for maintaining the integrity of the banking system and preventing illicit activities.

How Banks Apply CDD and Enhanced Due Diligence

Banks are required to comply with various regulations and guidelines which mandate customer due diligence procedures. These regulations aim to identify and prevent money laundering, terrorist financing, and other financial crimes.

To comply with these regulations, banks must establish robust customer identification programs, conduct thorough risk assessments, and implement ongoing monitoring procedures. Enhanced customer due diligence (ECDD) is often required for high-risk customers, such as Politically Exposed Persons (PEPs) and customers from high-risk jurisdictions.

Implementing Effective Customer Due Diligence Measures and Best Practices

Key Steps to Strengthen Your CDD Framework

- Conduct risk assessments to identify high-risk customers and apply appropriate due diligence measures.

- Use advanced technologies like EDD to verify customer identities and detect suspicious behavior.

- Train employees on AML compliance and the importance of CDD measures

- Maintain accurate and up-to-date records of customer information and due diligence activities.

The Future of Customer Due Diligence: Innovations, Technology, and Emerging Trends

How Technology Is Transforming Customer Due Diligence

The field of CDD is continually evolving, with new tools and solutions emerging to help businesses stay ahead of financial crime risks. Some of the latest innovations and emerging trends in the field include:

Key Innovations and Emerging Trends in CDD

- AI-powered identity verification tools that use machine learning algorithms to authenticate customer identities and detect fraud.

- Comprehensive KYC platforms that provide a more holistic view of customer risk by analyzing their behavior and activities across multiple channels.

- Blockchain-based solutions that offer secure and transparent record-keeping for customer information and transactions.

Ensuring Trust, Security, and Compliance with Customer Due Diligence Solutions

Building Long-Term Trust and Compliance Through Effective CDD

Customer Due Diligence is an essential aspect of AML compliance and helps businesses to mitigate the risk of financial crime and money laundering. By implementing robust CDD measures, organizations can identify high-risk customers, assess their risk levels, and monitor their activities for suspicious behavior. As the field of CDD continues to evolve, businesses must stay up-to-date with the latest tools and solutions to ensure regulatory compliance and protect their reputation.

Whether you are in the banking industry or any other sector, customer due diligence should be a top priority. By following the customer due diligence checklist, understanding the requirements, and complying with relevant.

Remember, customer due diligence is an ongoing process that requires regular monitoring and updating. By investing in the right people, processes, and technology, you can establish a solid foundation for effective customer due diligence and ensure the long-term success of your organization.

How ZIGRAM Empowers Businesses with Advanced CDD and AML Solutions

ZIGRAM products and solutions provide a fast and accurate way to avoid risks, verify users, and support your compliance obligations, all while offering a streamlined user experience that will boost your compliance journey. The solutions integrate Artificial Intelligence (AI) and Machine Learning (ML) frameworks to enable optimum results that ensure you’re always one step ahead in your compliance journey.

Checkout ZIGRAM products & services – https://www.zigram.tech/risk-app-ecosystem/

ZIGRAM is the one-stop solution for all your compliance needs. Try our FREE AML DEMO to experience what you’re missing in your AML and KYC processes!

- #CustomerDueDiligence

- #KnowYourCustomer

- #Compliance

- #AntiMoneyLaundering