In the realm of financial transparency and regulatory compliance, the concept of Ultimate Beneficiary Ownership (UBO) has gained significant attention in recent years. UBO refers to the natural person(s) who ultimately own or control a legal entity, such as a company or trust, and enjoy the benefits of its assets or income. The identification of UBO is crucial for combating money laundering, terrorist financing, tax evasion, and other financial crimes. Understanding UBO and implementing effective UBO regulations is essential for promoting integrity and accountability within the global financial system.

Unveiling the Layers of Ownership:

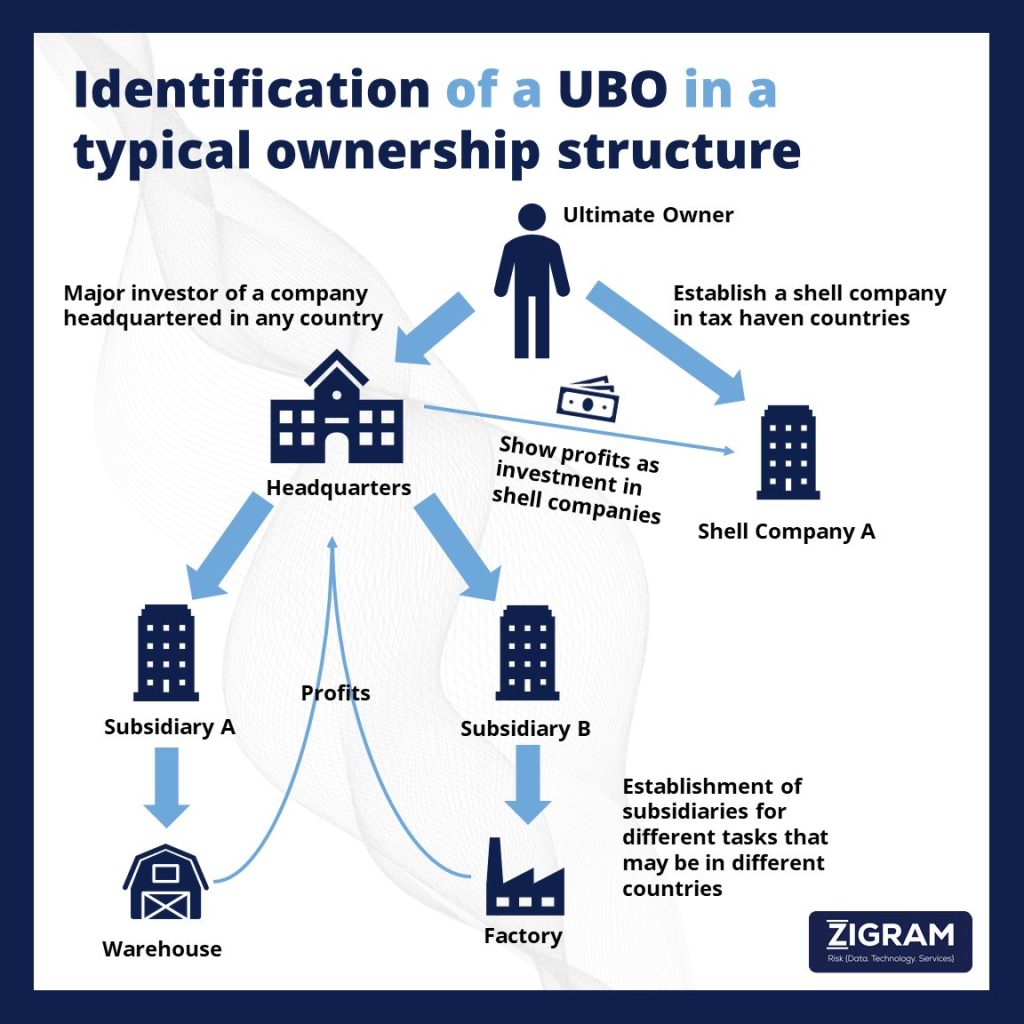

In many cases, legal entities are structured in complex hierarchies, involving multiple layers of ownership and control. These structures can be intentionally designed to obscure the true ownership interests behind a web of companies, trusts, or other entities. Consequently, determining the ultimate individuals who stand to benefit from these entities becomes a challenging task.

UBO regulations aim to cut through this complexity and reveal the ultimate individuals who wield significant control or ownership over an entity, regardless of the number of intermediary entities involved. By identifying the UBO, authorities can better assess the risks associated with financial transactions and take appropriate measures to prevent illicit activities.

Importance of UBO Disclosure:

1. Enhanced Transparency:

UBO disclosure enhances transparency in the financial system by providing clarity regarding the individuals who ultimately benefit from corporate structures. This transparency fosters trust among stakeholders and helps prevent illicit activities.

2. Risk Mitigation:

Knowing the UBO allows authorities to assess the potential risks associated with a particular entity or transaction. By understanding the ultimate beneficiaries, regulators can identify and mitigate the risks of money laundering, corruption, and other financial crimes.

3. Effective Regulation and Enforcement:

UBO regulations empower regulatory authorities to enforce anti-money laundering (AML) and counter-terrorism financing (CTF) measures more effectively. By requiring entities to disclose their ultimate beneficiaries, regulators can monitor and enforce compliance with relevant laws and regulations.

4. Tax Compliance:

UBO disclosure also plays a crucial role in ensuring tax compliance. By identifying the individuals who ultimately control or benefit from assets, tax authorities can prevent tax evasion and ensure that appropriate taxes are paid on income generated by entities.

Identification of Ultimate Beneficial Owners (UBOs):

Identifying the ultimate beneficial owners (UBOs) of legal entities is a critical step in implementing effective UBO disclosure regulations. However, the process of determining UBOs can be complex, particularly in cases involving intricate corporate structures and nominee arrangements. Here are some common methods and challenges associated with identifying UBOs:

1. Direct Ownership:

In some cases, the UBO may directly own a significant portion of the shares or voting rights in a company. Direct ownership is relatively straightforward to identify through shareholding records and corporate governance documents.

2. Indirect Ownership:

UBOs may also exert control over entities indirectly, through intermediate ownership structures or nominee arrangements. Unravelling these complex ownership chains often requires thorough investigation and analysis of corporate relationships.

3. Control through Trusts and Foundations:

Trusts and foundations are commonly used to hold assets and provide a layer of anonymity for beneficiaries. Identifying the ultimate beneficiaries of trusts and foundations may involve examining trust deeds, trustee records, and other relevant documentation.

4. Nominee Shareholders and Directors:

Nominee shareholders and directors are individuals or entities that hold shares or directorships on behalf of others, often to conceal the identity of the true owners. Identifying the beneficial owners behind nominee arrangements requires diligence and may involve conducting background checks and scrutinizing contractual agreements.

5. Use of Offshore Structures:

Offshore jurisdictions are frequently utilized to establish complex ownership structures that shield the identities of UBOs. Investigating offshore entities may require cooperation with international authorities and access to beneficial ownership registries in other jurisdictions.

In conclusion, while identifying UBOs remains a complex and evolving process, it is essential for promoting transparency and integrity in the global financial system. By employing a combination of regulatory measures, due diligence practices, and technological solutions, stakeholders can enhance their ability to identify and mitigate the risks associated with opaque ownership arrangements, thereby strengthening the resilience of the financial system against illicit activities.

Incorporating FATF Recommendations on UBO:

The Financial Action Task Force (FATF), an intergovernmental body established to combat money laundering and terrorist financing, has issued a set of recommendations that outline best practices for implementing UBO disclosure requirements. These recommendations serve as a global standard for combating financial crimes and are widely referenced by jurisdictions seeking to strengthen their regulatory frameworks.

FATF Recommendation 24 specifically addresses the issue of transparency and beneficial ownership of legal persons, emphasizing the importance of identifying and verifying the ultimate beneficiaries of corporate entities. According to FATF guidelines, countries should ensure that adequate, accurate, and timely information on beneficial ownership is available to competent authorities.

Moreover, FATF recommends that countries require legal persons, including companies and trusts, to maintain accurate and up-to-date beneficial ownership information. This information should be accessible to competent authorities, including law enforcement and financial intelligence units, for investigative purposes. FATF also encourages countries to consider extending beneficial ownership disclosure requirements to cover a wide range of entities, including trusts, partnerships, and other legal arrangements.

Furthermore, FATF emphasizes the need for international cooperation and information exchange to address cross-border challenges associated with UBO disclosure. Countries are urged to cooperate with each other and international organizations to share beneficial ownership information and facilitate investigations into illicit financial activities.

Incorporating FATF recommendations into UBO regulations strengthens the effectiveness of anti-money laundering and counter-terrorism financing efforts on a global scale. By aligning their regulatory frameworks with FATF standards, jurisdictions can enhance the transparency and integrity of their financial systems, contributing to the collective goal of combating financial crimes and protecting the stability of the international financial system.

Implementation of UBO Regulations in Various Countries:

In response to international pressure and in alignment with FATF recommendations, many countries have enacted or enhanced their UBO disclosure requirements. These regulations vary in scope, stringency, and enforcement mechanisms, reflecting the diverse legal and regulatory landscapes across different jurisdictions. Here are examples of UBO regulations implemented in various countries:

1. United States:

The United States implemented the Corporate Transparency Act (CTA) in 2021, establishing a beneficial ownership registry at the federal level. Under the CTA, certain corporations, limited liability companies (LLCs), and other similar entities are required to report information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN).

2. United Kingdom:

The UK introduced the Persons with Significant Control (PSC) register in 2016 as part of its efforts to enhance corporate transparency. Companies, LLPs (Limited Liability Partnerships), and other legal entities are required to maintain a register of individuals or legal entities with significant control over them. This information must be filed with Companies House and is publicly accessible.

3. European Union:

The EU's Fourth Anti-Money Laundering Directive (AMLD4) and Fifth Anti-Money Laundering Directive (AMLD5) have introduced UBO disclosure requirements for corporate entities and legal arrangements across member states. Additionally, the EU's Sixth Anti-Money Laundering Directive (AMLD6) further strengthens UBO regulations and extends transparency measures to cover a broader range of entities.

4. Canada:

Canada amended its Proceeds of Crime (Money Laundering) and Terrorist Financing Act in 2019 to require corporations, trusts, and other legal entities to maintain beneficial ownership information. While the central registry of beneficial ownership has not yet been established, these entities are required to disclose beneficial ownership information to certain authorities upon request.

5. Singapore:

Singapore amended its Companies Act in 2017 to enhance transparency and combat money laundering and terrorism financing. Companies incorporated in Singapore are required to maintain registers of controllers, which include individuals or entities with significant interests or control over the company. These registers must be kept up-to-date and made available for inspection by regulatory authorities.

6. Australia:

Australia enacted the Modern Slavery Act in 2018, which includes provisions requiring certain entities to report on modern slavery risks in their operations and supply chains. While not specifically focused on UBO, this legislation highlights the growing emphasis on corporate transparency and accountability in Australia.

These examples illustrate the global trend towards enhancing UBO disclosure requirements as part of broader efforts to combat financial crimes and promote transparency in corporate ownership structures. While regulations may vary from country to country, the overarching goal remains the same: to identify and mitigate the risks associated with opaque corporate ownership and control arrangements, thereby safeguarding the integrity of the financial system.

Challenges in Implementing UBO Regulations:

While the importance of UBO disclosure is widely recognized, implementing effective UBO regulations poses several challenges:

1. Complex Corporate Structures:

Some entities use complex corporate structures spanning multiple jurisdictions to obscure UBO information. Untangling these structures requires international cooperation and robust regulatory frameworks.

2. Data Accuracy and Verification:

Ensuring the accuracy of UBO data and verifying the identities of ultimate beneficiaries can be challenging, especially in cases involving nominee shareholders or directors.

3. Compliance Costs:

Compliance with UBO regulations may impose additional administrative burdens and costs on businesses, particularly small and medium-sized enterprises (SMEs). Balancing regulatory requirements with the need to support business growth is essential.

4. Jurisdictional Variations:

UBO regulations vary significantly across jurisdictions, leading to inconsistencies and loopholes that can be exploited by illicit actors. Harmonizing UBO requirements globally is crucial for effective implementation.

Solutions to Ultimate Beneficial Ownership (UBO) Challenges:

Addressing the complexities and challenges associated with Ultimate Beneficial Ownership (UBO) requires a multifaceted approach involving regulatory reforms, technological innovations, international cooperation, and stakeholder engagement. Here are some solutions to improve the effectiveness of UBO regulations and enhance transparency in corporate ownership:

1. Enhanced Regulatory Frameworks:

- Implementing comprehensive UBO disclosure requirements that cover a wide range of legal entities, including companies, trusts, and partnerships.

- Establishing centralized beneficial ownership registries accessible to competent authorities, financial institutions, and other obligated entities.

- Enforcing robust penalties for non-compliance with UBO regulations to deter illicit activities and ensure accountability.

2. Technological Innovations:

- Leveraging advanced data analytics, artificial intelligence, and machine learning algorithms to analyze large volumes of data and identify patterns indicative of beneficial ownership interests.

- Developing digital platforms and tools to facilitate the collection, verification, and sharing of UBO information among relevant stakeholders.

- Exploring blockchain technology to create immutable and transparent registries of beneficial ownership, enhancing data integrity and security.

3. International Cooperation:

- Strengthening cooperation and information exchange mechanisms among countries to combat cross-border illicit financial flows and money laundering activities.

- Harmonizing UBO regulations and standards at the international level to promote consistency and interoperability across jurisdictions.

- Supporting capacity-building initiatives in developing countries to enhance their regulatory frameworks and enforcement capabilities related to UBO disclosure.

4. Stakeholder Engagement:

- Encouraging proactive engagement and cooperation from legal entities, financial institutions, professional service providers, and civil society organizations in complying with UBO regulations.

- Promoting awareness and understanding of UBO requirements among stakeholders through education, training, and outreach initiatives.

- Facilitating dialogue and collaboration between governments, industry associations, and advocacy groups to address emerging challenges and identify best practices in UBO disclosure.

5. Public Transparency and Accountability:

- Advocating for greater transparency and accountability in corporate ownership structures to mitigate the risks of corruption, tax evasion, and money laundering.

- Empowering civil society organizations, journalists, and whistleblowers to scrutinize and expose instances of opaque beneficial ownership arrangements.

- Encouraging companies to adopt responsible business practices and voluntarily disclose their beneficial ownership information to build trust with stakeholders and enhance their reputation.

By adopting these solutions and fostering collaboration among stakeholders, the global community can make significant strides in improving the transparency and integrity of corporate ownership structures. Ultimately, effective UBO regulations play a crucial role in safeguarding the financial system against abuse and illicit activities, promoting economic stability, and upholding the rule of law.

Ultimate Beneficiary Ownership (UBO) is a cornerstone of efforts to enhance transparency and combat financial crimes in the global financial system. By identifying the individuals who ultimately control or benefit from legal entities, UBO regulations enable authorities to mitigate risks, enforce regulations, and promote integrity. However, addressing the challenges associated with UBO disclosure requires concerted efforts from governments, regulatory bodies, businesses, and other stakeholders. By working together to implement robust UBO regulations, the international community can strengthen the resilience and integrity of the financial system, fostering trust and stability for all stakeholders.

ZIGRAM is the one-stop solution for all your compliance needs. Try our FREE DEMO to experience what you’re missing in your AML and KYC processes!

- #UltimateBeneficiaryOwner

- #Due_Diligence

- #Transparency

- #Compliance