The fifth Plenary of the Financial Action Task Force (FATF) recently concluded under the presidency of T. Raja Kumar of Singapore. Delegates from over 200 jurisdictions and international organizations engaged in three days of discussions at the FATF headquarters in Paris, focusing on critical issues related to money laundering, terrorism financing, and proliferation financing.

Key Outcomes

- New Risk-Based Guidance on Beneficial Ownership (Recommendation 25):

One of the significant outcomes is the introduction of risk-based guidance for the implementation of Recommendation 25, emphasising beneficial ownership and transparency of legal arrangements. This finalises the FATF's efforts to enhance global transparency in beneficial ownership, discouraging criminals and terrorists from concealing their activities behind intricate corporate structures and legal arrangements. - Wire Transfers:

The Plenary agreed to release options for potential changes to Recommendation 16 and its Interpretive Note on wire transfers. These proposed revisions aim to adapt FATF Standards to evolving payment system business models and messaging standards, ensuring technology-neutral approaches. - Mutual Evaluations and Non-Profit Organizations:

Modifications to the assessment methodology were finalized to align with recent revisions to the FATF Standards, particularly in safeguarding non-profit organizations from potential abuse for terrorist financing. This proactive step prepares for the next round of mutual evaluations. - Virtual Asset Activity:

Jurisdictions with materially important virtual asset activity were identified, indicating the FATF's commitment to supporting their compliance with regulations governing virtual assets. The task force is actively working to supervise and regulate virtual asset activities globally.

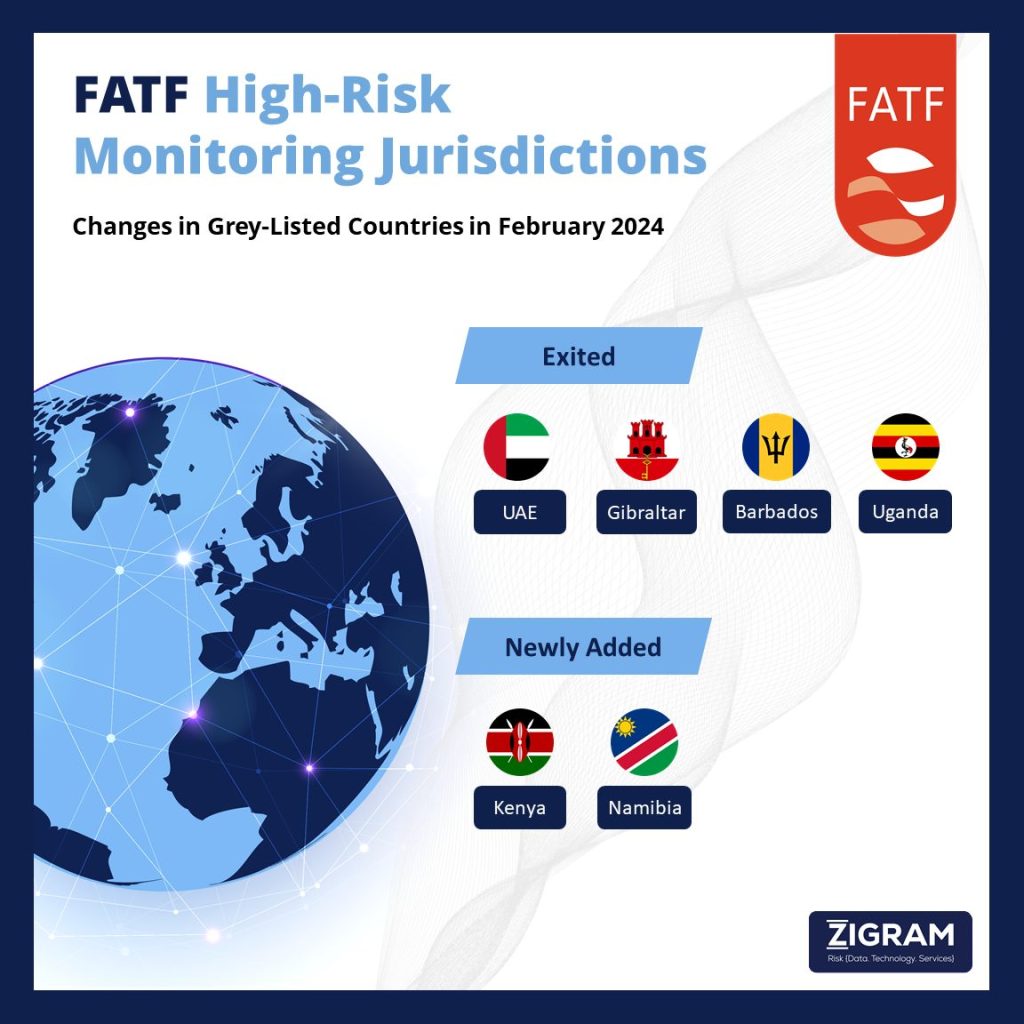

Monitoring High-Risk Jurisdictions: Progress and Recognition

A focal point of the Plenary was the assessment of jurisdictions under increased monitoring. Countries actively collaborating with the FATF to rectify strategic deficiencies in countering financial crimes found themselves under the spotlight. Notably, Kenya and Namibia were added to the list of jurisdictions subject to increased monitoring. Conversely, the FATF acknowledged and applauded the significant progress made by Barbados, Gibraltar, Uganda, and the United Arab Emirates. Successful on-site visits and the implementation of Action Plans saw these nations removed from increased monitoring.

Jurisdictions subject to a call for action

The Financial Action Task Force (FATF) continues its vigilant oversight of global financial systems, identifying and addressing strategic deficiencies in the anti-money laundering and combating the financing of terrorism (AML/CFT) regimes of specific jurisdictions. In the latest developments, the FATF has spotlighted the Democratic People’s Republic of Korea (DPRK), Iran, and Myanmar, urging heightened measures to counteract the risks and potential threats they pose to the international financial landscape.

Democratic People's Republic of Korea (DPRK):

The FATF expresses sustained concern over the DPRK's failure to rectify significant deficiencies in its AML/CFT regime. Additionally, the FATF is alarmed by the DPRK's illicit activities related to the proliferation of weapons of mass destruction (WMDs) and its financing. In response, the FATF reaffirms its call for increased scrutiny of business relationships and transactions with the DPRK, urging financial institutions globally to pay special attention to dealings involving DPRK companies and financial entities.

Moreover, the FATF calls upon its members to apply effective countermeasures and targeted financial sanctions in accordance with relevant United Nations Security Council Resolutions. This includes the closure of existing branches, subsidiaries, and representative offices of DPRK banks within their territories, as mandated by UN resolutions.

Iran:

Iran's commitment to addressing its strategic deficiencies in AML/CFT was noted in June 2016, but the expiration of its action plan in January 2018 raised concerns. Despite the FATF's call for increased supervisory measures in October 2019, Iran failed to enact the Palermo and Terrorist Financing Conventions aligned with FATF standards.

As a consequence, the FATF has lifted the suspension of countermeasures and urges its members and jurisdictions to apply effective countermeasures in line with Recommendation 19. Iran will remain on the list of High-Risk Jurisdictions Subject to a Call for Action until the full Action Plan is completed. The FATF emphasizes that until Iran implements the required measures to address terrorism financing deficiencies, the threat to the international financial system remains a concern.

Myanmar:

Myanmar, having committed to addressing its strategic deficiencies in February 2020, faced a significant lack of progress beyond the action plan deadline in September 2021. The FATF, noting continued sluggish progress and incomplete action items in October 2022, called for enhanced due diligence measures proportionate to the risks arising from Myanmar.

Despite some prioritization of inspection in certain sectors, overall progress remains slow. Myanmar is urged to work diligently on implementing its action plan, demonstrating an improved understanding of money laundering (ML) risks, registering and supervising hundi operators, and enhancing the use of financial intelligence in law enforcement.

The FATF emphasizes the importance of Myanmar addressing AML/CFT deficiencies, including demonstrating effective monitoring and supervision of money or value transfer services (MVTS) to mitigate undue scrutiny of legitimate financial flows. Until Myanmar completes its full action plan, it will remain on the list of countries subject to a call for action.

Strategic Initiatives for 2024-2026: Building a Secure Financial Future

Delegates engaged in forward-looking discussions, setting strategic priorities for 2024-2026. With a mandate to prevent criminals, corruption, and terrorists from exploiting the international financial system, the FATF aims to strengthen the foundations for sustainable and inclusive economic development. These strategic priorities will be presented at the upcoming FATF Ministerial meeting in April.

Enhancing Beneficial Ownership Transparency: A Global Imperative

A noteworthy outcome was the introduction of risk-based guidance for the implementation of Recommendation 25, focusing on beneficial ownership and transparency of legal arrangements. This initiative, aligned with the February 2023 revisions to FATF Recommendation 25, aims to improve global transparency and thwart criminals and terrorists from hiding behind intricate corporate structures. The updated guidance will be instrumental in identifying and preventing illicit activities conducted through shell companies, trusts, and other legal arrangements.

Leveraging Digital Transformation: Virtual Assets

Addressing the borderless nature of virtual asset activity, the FATF Plenary focused on strengthening the implementation of Recommendation 15. Recognizing the potential loopholes exploited by criminals and terrorists due to incomplete adoption, the FATF conducted a comprehensive stocktake of current global implementation levels. The Plenary agreed to publish an overview of measures taken by jurisdictions with significant virtual asset activity to regulate and supervise Virtual Asset Service Providers (VASPs).

Advancements in Payment Transparency

Acknowledging the evolving landscape of cross-border payment systems and industry standards, the FATF worked on proposed amendments to Recommendation 16. These amendments aim to make cross-border payments faster, cheaper, more transparent, and more inclusive while ensuring compliance with Anti-Money Laundering/Counter Financing of Terrorism (AML/CFT) standards. The proposed revisions will be open for public consultation.

Protecting Non-Profit Organizations: Mitigating Terrorist Financing Risks

The FATF's commitment to safeguarding non-profit organizations (NPOs) from potential terrorist financing abuse was evident in the October 2023 Plenary. Amendments to Recommendation 8 were agreed upon, along with updated best practices. The FATF emphasized the importance of applying risk-based measures to protect vulnerable NPOs, ensuring effective implementation without unduly disrupting legitimate activities.

FATF Presidency 2024-2026: A New Leadership Era

In a crucial decision, the Plenary appointed Ms Elisa de Anda Madrazo of Mexico as the next President of the FATF for a fixed two-year term. Following a comprehensive process and consultations with all delegations, Ms. de Anda Madrazo will assume duties on July 1, 2024, succeeding the two-year Presidency of Mr. T. Raja Kumar.:

FATF Statement on the Russian Federation: Condemnation and Suspension

In a statement released on February 24, 2023, the Financial Action Task Force (FATF) strongly condemned the Russian Federation's illegal and unprovoked military invasion of Ukraine, marking one year since the egregious act. Expressing deep sympathies for the people of Ukraine, the FATF deplored the significant loss of lives and the destructive impact caused by the ongoing brutal attack.

The FATF acknowledged the United Nations General Assembly Resolution ES-11/1, which demands the immediate, complete, and unconditional withdrawal of all Russian military forces from Ukrainian territory within internationally recognized borders.

Over the past year, the Russian Federation has intensified inhumane attacks targeting critical public infrastructure, drawing the FATF's deep concern. Reports of arms trade with UN-sanctioned jurisdictions and malicious cyber activities originating from Russia further compounded the international condemnation.

The actions of the Russian Federation were deemed unacceptable and in direct contradiction to the FATF core principles that aim to promote security, safety, and the integrity of the global financial system. Such actions also represented a gross violation of the commitment to international cooperation and mutual respect, leading the FATF to decide on the suspension of the Russian Federation's membership.

Despite the suspension, the Russian Federation remains accountable for implementing FATF Standards and must fulfill its financial obligations. The country will still be a member of the Global Network, maintaining an active role in the Eurasian Group on Combating Money Laundering (EAG) and retaining rights as an EAG member. The FATF will regularly assess the situation during Plenary meetings, contemplating the potential lifting or modification of restrictions.

The FATF urges all jurisdictions to remain vigilant against threats to the integrity, safety, and security of the international financial system arising from the Russian Federation's war against Ukraine. It emphasizes the importance of alertness to emerging risks that may arise from attempts to circumvent protective measures and calls for necessary actions to mitigate these risks.

The outcomes of the fifth Plenary highlight the FATF's continued commitment to strengthening the global financial system against various financial crimes. With new guidance on beneficial ownership, proposed amendments to wire transfer recommendations, and ongoing efforts in virtual asset regulation, the FATF remains at the forefront of international efforts to combat money laundering, terrorism financing, and proliferation financing. The appointment of Ms. Elisa de Anda Madrazo signals a new phase of leadership that will guide the FATF in its critical mission over the next two years.

ZIGRAM is the one-stop solution for all your compliance needs. Try our FREE DEMO to experience what you’re missing in your AML and KYC processes!

- #FATF

- #5th_Plenary_Meeting

- #High_Risk_Jurisdictions

- #AML

- #Compliance