In the global fight against financial crime amd anti money laundering (AML), the Financial Action Task Force (FATF) and the Wolfsberg Group play pivotal roles in shaping and enhancing AML practices. As international organizations, their primary focus is to develop and promote policies and standards that safeguard the global financial system from the illicit flow of funds. This article delves into the origins, functions, and impact of the FATF and Wolfsberg Group on AML, highlighting the collaborative efforts aimed at creating a robust framework to combat money laundering.

The Financial Action Task Force (FATF)

Background and Establishment

The FATF, established in 1989 during the G7 Summit in Paris, emerged as a response to the growing concern over the global expansion of money laundering activities. Initially created to address the money laundering threats emanating from the drug trade, the FATF quickly evolved to tackle a broader spectrum of financial crimes. Today, it stands as the foremost international body in the fight against money laundering and terrorist financing.

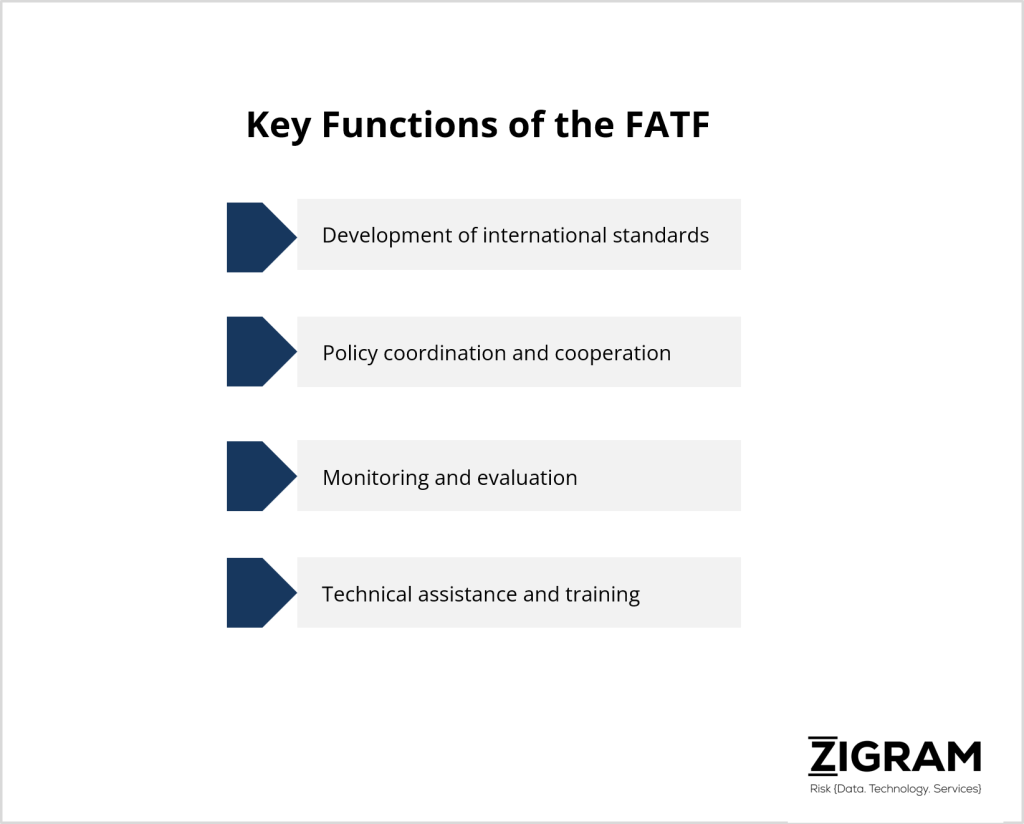

Objectives and Functions

The primary objectives of the FATF are to set international standards and promote the implementation of legal, regulatory, and operational measures to combat money laundering and terrorist financing. The FATF operates as a policy-making body that monitors and reviews the effectiveness of its recommendations across its member jurisdictions. With a focus on achieving consistent and comprehensive AML practices globally, the FATF issues recommendations, guidance, and best practices that serve as a benchmark for national AML efforts.

The FATF Recommendations

The FATF Recommendations constitute a comprehensive set of measures designed to combat money laundering and terrorist financing. These recommendations cover areas such as customer due diligence, reporting of suspicious transactions, record-keeping, and the establishment of Financial Intelligence Units (FIUs). The FATF regularly updates these recommendations to adapt to the evolving nature of financial crimes and to address emerging challenges.

Global Impact and Influence

The influence of the FATF extends beyond its member countries, as its recommendations are widely acknowledged and adopted globally. Non-compliance with FATF standards can result in significant consequences for countries, including reputational damage, restricted access to international financial markets, and the imposition of sanctions. The FATF’s role as a catalyst for international cooperation underscores its significance in shaping global AML policies.

The Wolfsberg Group

Genesis and Composition

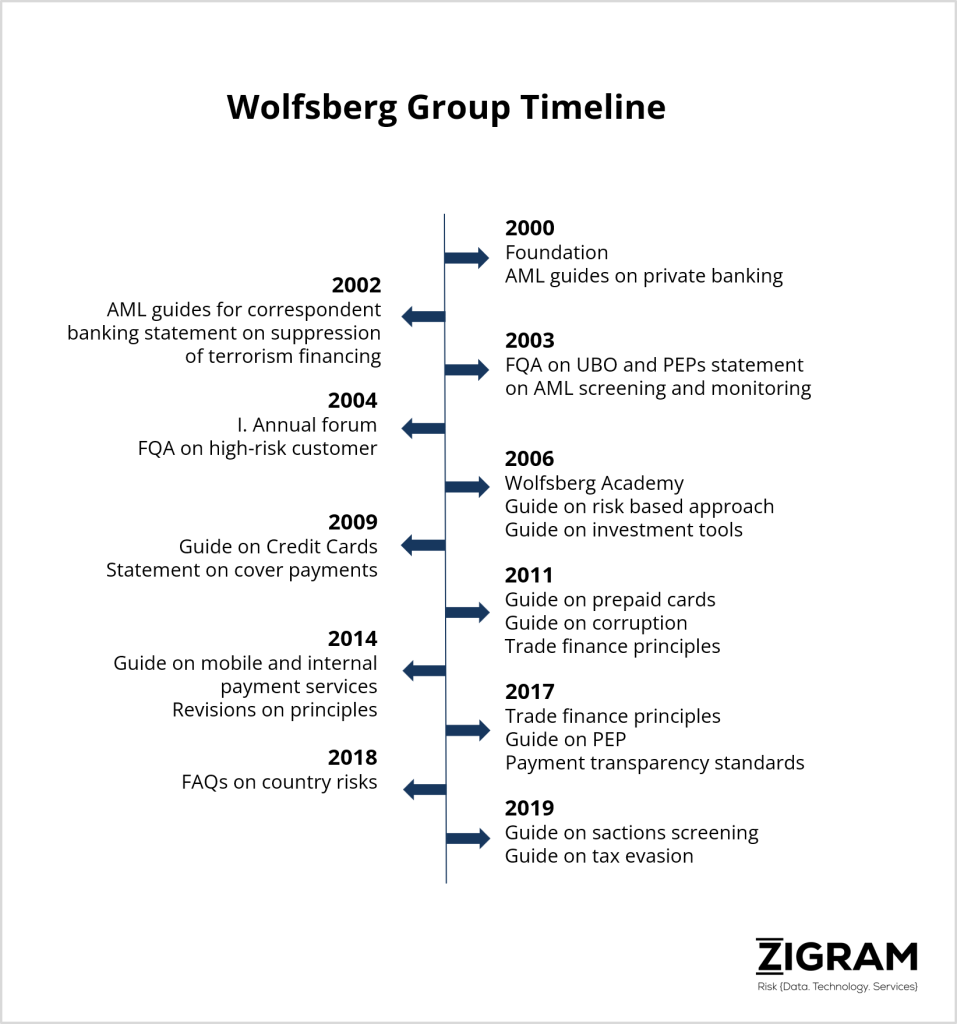

The Wolfsberg Group, established in 2000, comprises thirteen global banks that collaborate to develop industry standards and promote best practices in the fight against financial crime. Named after the Wolfsberg Castle in Switzerland where its founding members convened, the group focuses on addressing AML and Counter-Terrorist Financing (CTF) challenges specific to the banking sector.

Objectives and Functions

The Wolfsberg Group aims to enhance the effectiveness of AML and CTF measures within the banking industry by fostering collaboration, sharing insights, and developing common approaches. Unlike the FATF, the Wolfsberg Group does not set international standards but focuses on creating guidelines that reflect the practical experiences of its member banks. These guidelines are designed to complement existing regulations and facilitate the implementation of robust AML practices.

Wolfsberg Group’s Products and Initiatives

The Wolfsberg Group has produced several key documents and initiatives that have become industry benchmarks. Notable among these is the Wolfsberg Anti-Money Laundering Principles for Correspondent Banking, which provides guidance on risk-based due diligence for correspondent banking relationships. Additionally, the Wolfsberg Group has developed guidance on topics such as trade finance, customer due diligence, and sanctions screening.

Collaborative Efforts with the FATF

While the Wolfsberg Group does not possess the regulatory authority of the FATF, its collaborative efforts with the task force are crucial for promoting consistency and effectiveness in AML practices. The group actively engages with the FATF, contributing industry perspectives and insights to the policy-making process. This collaboration helps bridge the gap between global standards and industry-specific challenges faced by banks.

Impact on Anti-Money Laundering (AML)

The combined efforts of the Financial Action Task Force (FATF) and the Wolfsberg Group have had a profound impact on the landscape of Anti-Money Laundering (AML) practices globally. These organizations, through their recommendations, guidelines, and collaborative initiatives, have significantly influenced the development and implementation of AML frameworks in both the public and private sectors. The impact can be observed across various dimensions:

Global Standardization and Consistency

One of the primary impacts of the FATF is the establishment of global standards for AML. The FATF Recommendations provide a comprehensive and consistent framework that countries are encouraged to adopt and implement. This standardization is crucial in fostering a coordinated global effort against money laundering and terrorist financing. The Wolfsberg Group, while not setting global standards, contributes by providing industry-specific guidance that complements the FATF framework. The result is a more cohesive and universally applicable set of AML measures.

Enhanced Banking Sector Practices

The Wolfsberg Group's influence on the banking sector is particularly noteworthy. The group's principles and guidance, developed by major global banks, serve as benchmarks for industry best practices. Banks that are members of the Wolfsberg Group often adopt these guidelines voluntarily, leading to enhanced due diligence processes, improved risk management, and a higher level of scrutiny in correspondent banking relationships. This has a direct impact on the ability of financial institutions to detect and prevent money laundering within their operations.

Risk-Based Approach Implementation

Both the FATF and the Wolfsberg Group advocate for a risk-based approach to AML. This approach recognizes that the risks of money laundering and terrorist financing can vary across different sectors, regions, and institutions. By endorsing risk-based AML frameworks, these organizations have encouraged jurisdictions and financial institutions to tailor their preventive measures according to the specific risks they face. This adaptability enhances the efficiency and effectiveness of AML efforts.

Increased Information Sharing and Collaboration

The collaboration between the FATF and the Wolfsberg Group fosters a culture of information sharing and collaboration among member countries and financial institutions. This exchange of insights, experiences, and best practices contributes to a more informed and proactive AML community. The emphasis on collaboration extends beyond the public and private sectors, encompassing partnerships with law enforcement agencies, regulators, and other stakeholders. This interconnected approach strengthens the collective ability to combat money laundering on a global scale.

Market Access and Reputational Impact

Non-compliance with the FATF standards can have severe consequences for countries, including restricted access to international financial markets and damaged reputations. The impact is not limited to nations; financial institutions that fail to adhere to the AML principles endorsed by the Wolfsberg Group may also face reputational risks. The shared commitment to AML principles and standards, therefore, serves as a powerful incentive for both countries and financial institutions to align with global best practices.

Technological Innovation and Adaptation

The recognition of the evolving nature of financial crimes by both the FATF and the Wolfsberg Group has led to an emphasis on technological innovation. The impact of emerging technologies, such as artificial intelligence and blockchain, is acknowledged, and efforts are underway to incorporate these advancements into AML measures. This focus on innovation positions the global AML community to stay ahead of sophisticated money laundering techniques facilitated by technological developments.

Capacity Building and Professional Development

The emphasis on training and capacity building, supported by both organizations, has contributed to the professionalization of AML practitioners. The availability of resources, guidance, and best practices enhances the skills and knowledge of individuals responsible for implementing AML measures. This impact is particularly significant in developing countries and emerging markets, where building the capacity of AML professionals is essential for effective implementation.

Balancing Security and Financial Inclusion

The impact on achieving a balance between security and financial inclusion is evident. By promoting risk-based approaches and recognizing the importance of inclusive financial systems, the FATF and the Wolfsberg Group contribute to striking a delicate balance. This impact is crucial for preventing exclusion of individuals and businesses from the formal financial sector while ensuring robust measures are in place to combat illicit financial activities.

Balancing Security and Financial Inclusion

The impact on achieving a balance between security and financial inclusion is evident. By promoting risk-based approaches and recognizing the importance of inclusive financial systems, the FATF and the Wolfsberg Group contribute to striking a delicate balance. This impact is crucial for preventing exclusion of individuals and businesses from the formal financial sector while ensuring robust measures are in place to combat illicit financial activities.

The collaboration and influence of the Financial Action Task Force and the Wolfsberg Group have shaped the global AML landscape, fostering a culture of cooperation, standardization, and innovation. The impact extends beyond regulatory frameworks, influencing the practices of financial institutions, the development of industry standards, and the capacity of professionals dedicated to combating money laundering. As the challenges posed by financial crimes continue to evolve, the impact of these organizations will remain pivotal in maintaining the integrity of the global financial system.

ZIGRAM is the one-stop solution for all your compliance needs. Try our FREE DEMO to experience what you’re missing in your AML and KYC processes!

- #FATF

- #Wolfsberg

- #RegTech

- #AntiMoneyLaundering