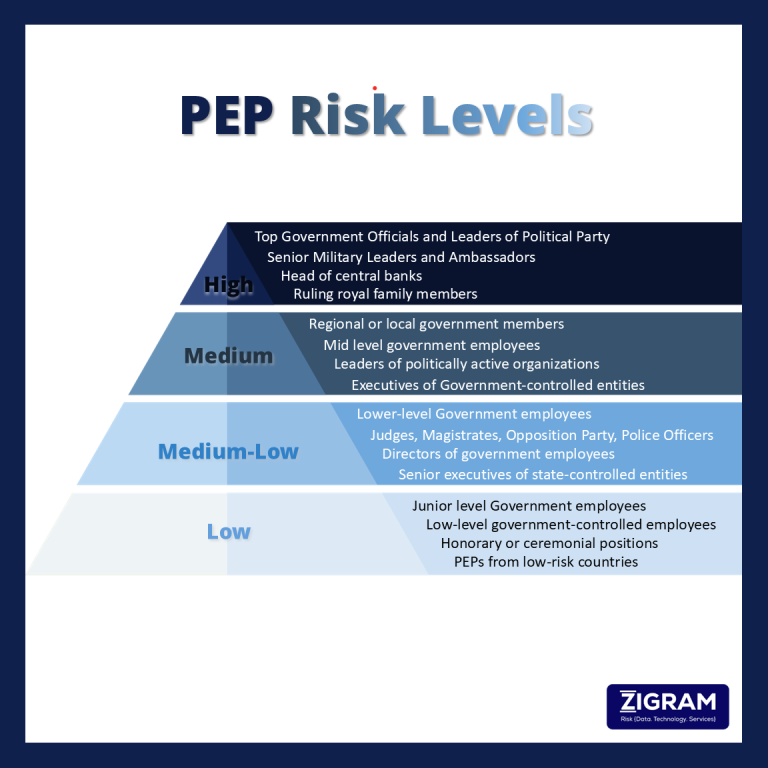

PEPs are classified as people occupying positions of influence in the public domain. This puts them at more significant risk of bribery, corruption, and other financial crimes. Their position of influence and access to sensitive information places them at risk of the abuse of power. Financial institutions and companies need to employ EDD in conducting their business with PEPs since the international AML and anti-bribery regimes realize the risks attached to the presence of PEPs. Classifying PEPs and understanding the risk attached thereto is quite significant in designing effective risk management strategies and keeping with regulatory standards.

Who is a Politically Exposed Person?

The Financial Action Task Force (FATF) defines a PEP as a person performing public functions, domestically or internationally. These include heads of state, senior government officials, military leaders and their associated staff, judicial figures, senior executives of state-owned enterprises, and other individuals in a position to exercise significant influence over the political decision-making process within a political party. Moreover, the FATF rules expand PEP categorization to include close family members and associates, as these individuals may share in or benefit from corrupt activity because of their relation to a PEP.

PEPs are found in all sectors: the political, judicial, armed forces, and international, where their influence and position can be used, accidentally or intentionally, for illicit transactions. Heads of state, senior politicians, high-ranking military officers, and heads of state-owned enterprises are all examples of a PEP. Knowing them and the level of control they exercise is part of conducting due diligence.

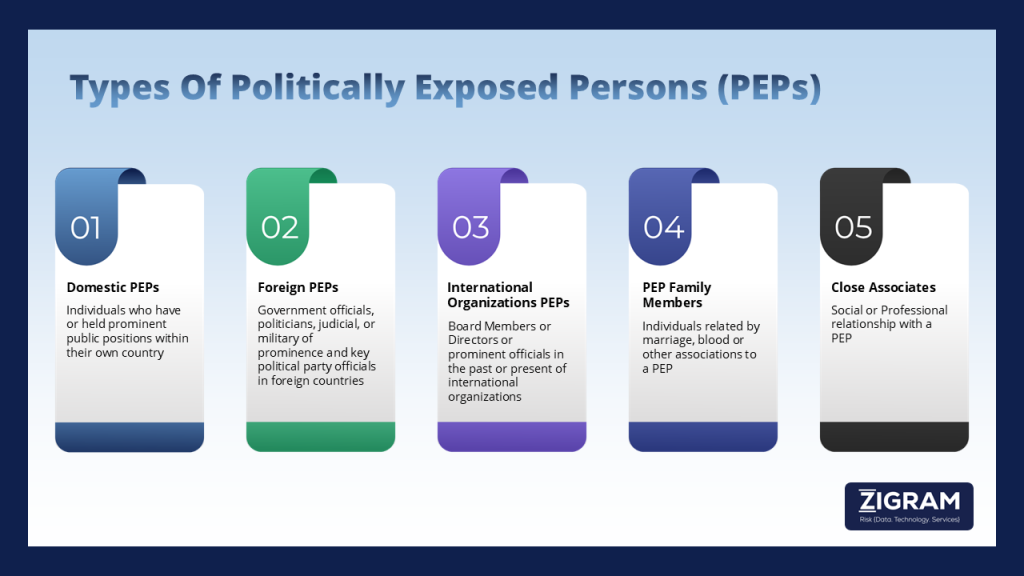

Types of PEPs

Domestic PEPs

Those who enjoy important political or public position in the state, e.g. Members of the Parliament, ministers, officers of higher ranks. Domestic PEPs could have influence over large sums of local resources and the implementation of crucial decisions on that level of governance and hence are vital for the research.

Foreign PEPs

Those who hold equivalent positions in foreign governments. Operating with foreign PEPs is generally riskier in many ways due to intricately difficult geopolitical considerations, including international regulations, political stability, and the specifics of anti-corruption legislation. Interaction with foreign PEPs may require an additional series of screening.

International Organization PEPs

Individuals holding positions of influence within international organizations like the United Nations, International Monetary Fund, or World Bank. They are more relevant due to their international presence. The nature of the standards of regulation and governance is bound to be different when cross-border transactions take place.

PEP Family Members

PEP Family Members include individuals who are related to a Politically Exposed Person by marriage, blood, or other close associations. Due to their relationship with a PEP, these individuals may have access to or influence over resources and are often subject to similar levels of scrutiny to mitigate the risk of financial crimes such as money laundering or corruption. Family members of PEPs may inadvertently or intentionally be used as channels for illicit activities, making it essential for institutions to include them in enhanced due diligence processes.

Close Associates

Close Associates are individuals who maintain a social or professional relationship with a PEP. These relationships can extend to business partners, close friends, or advisors who may have access to inside information or resources. Due to their proximity and potential involvement in a PEP's activities, close associates are considered high-risk in financial crime prevention efforts. They require thorough screening as part of AML compliance to detect any misuse of influence or potential involvement in suspicious transactions.

Each of the types of PEP above carries specific risks and challenges thus calling for the development of risk mitigation approaches which take into account the particular functions and duties of these people.

What Are the Risks Associated With PEPs?

Dealing with PEPs exposes financial institutions to a variety of risks, including

- Bribery and Corruption: PEPs have greater opportunities and potential for engaging in corrupt practices, such as soliciting bribes or using their position to influence decisions that benefit their interests. This risk is amplified in regions where governance structures are weak, and transparency is limited.

- Money Laundering: Due to their privileged access to state resources and international networks, PEPs may be more inclined to use financial systems to launder illicit funds. Corrupt PEPs often establish complex legal structures to disguise the true ownership of assets, making it challenging for financial institutions to trace the origin of funds.

- Reputational Risks: Financial institutions associated with corrupt PEPs face severe reputational consequences, which can lead to public distrust and loss of credibility. This risk impacts both public perception and the confidence of shareholders, clients, and regulatory bodies in the institution's commitment to ethical practices.

- Legal Risks: Institutions that fail to conduct proper due diligence when dealing with PEPs may incur legal penalties for non-compliance with AML and anti-bribery regulations. This could include fines, sanctions, and restrictions on business operations. The potential for legal repercussions emphasizes the importance of robust PEP risk management practices.

Challenges In Managing PEP Risks

Managing PEP risks presents several challenges due to the complexities of global regulations and the often-hidden nature of PEP involvement in financial crimes. Major challenges include:

- Evolving Definitions: PEP definitions vary widely across jurisdictions, making it challenging for institutions to maintain consistent criteria for identifying PEPs. Some jurisdictions focus on senior government roles, while others may include local officials or international sports figures, complicating global compliance.

- Global Financial Systems: PEPs often operate across borders, using international financial systems to move assets and evade detection. This global scope necessitates a broad, internationally compliant approach to risk management that accounts for varying local regulations and international standards.

- Privacy Concerns: Enhanced due diligence requires collecting detailed personal and financial data on PEPs, which raises privacy concerns. Institutions must strike a balance between gathering necessary information for risk assessment and respecting individual privacy rights.

- Hidden Beneficial Ownership: PEPs may obscure their financial dealings through intermediaries, shell companies, or offshore entities, making it harder for institutions to trace ownership and detect underlying risks.

Given these challenges, financial institutions must employ sophisticated tools and practices to address the unique risks posed by PEPs.

Mitigating Risks Associated With PEPs

To effectively manage the risks associated with PEPs, financial institutions can adopt the following strategies:

- Regularly update PEP lists and databases to stay current with evolving PEP profiles.

- Train employees to identify PEPs and understand the importance of recognizing politically exposed individuals.

- Implement automated systems to flag potential PEPs quickly and efficiently.

- Document all PEP screening processes to maintain a clear compliance record.

- Conduct adverse media searches for insights into negative news or activities related to PEPs.

- Utilize third-party databases and reports for comprehensive PEP identification and verification.

By adopting these practices, institutions can enhance their due diligence processes, reduce exposure to financial and reputational risks, and improve overall compliance.

Get weekly updates about PEP related news from PEP tracker

- #PEPs

- #classifications

- #risks

- #PoliticallyActive

- #AMLCFT